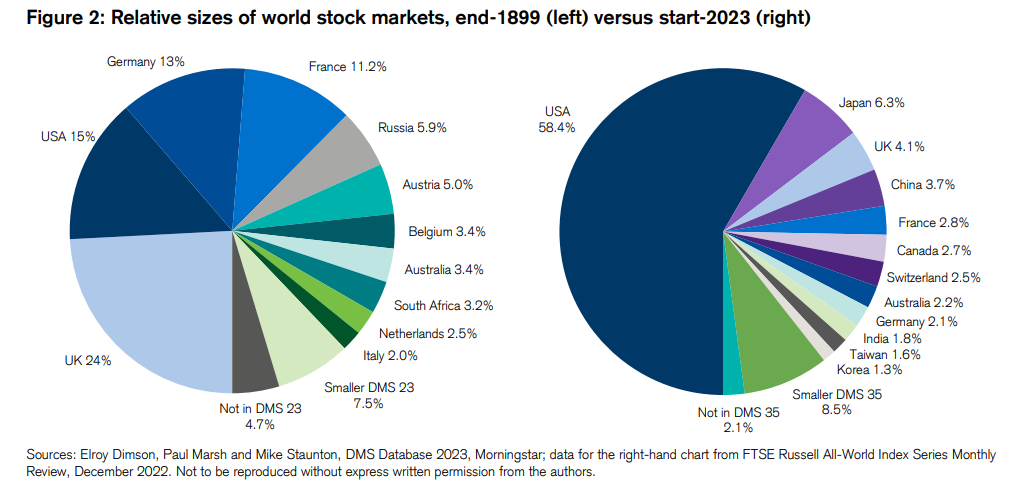

America makes up almost 60% of the worldwide inventory market by market capitalization:

The dominance of American shares over the remainder of the world wasn’t only a Twentieth-century phenomenon both.

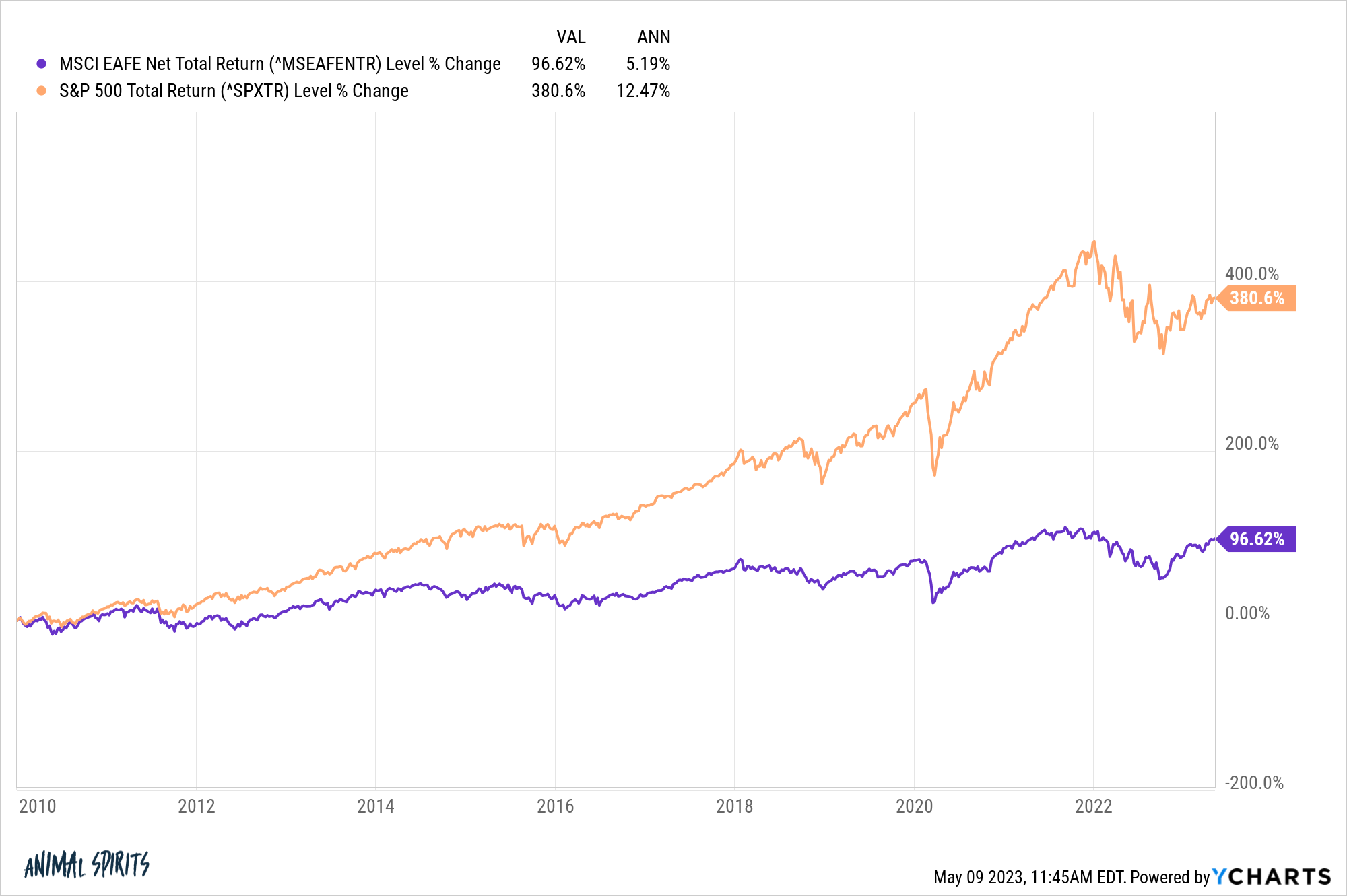

The efficiency over the previous decade and alter reveals U.S. shares successful palms down over our international counterparts:

Many buyers take a look at these numbers and surprise: What’s the purpose of proudly owning worldwide shares if the U.S. is clearly the one sport on the town?

I perceive the sentiment. America has nearly all of the largest and finest corporations on the planet. A lot of these firms are multi-national and get a good share of their income from abroad.

Having mentioned that, it’s nonetheless worthwhile to think about worldwide diversification over the long-run.

We’ve got MSCI knowledge for worldwide shares going again to 1970. Listed below are the annual returns for the S&P 500 and MSCI World ex-U.S. via April 2023:

- U.S. shares +10.5%

- Worldwide shares +9.1%

That’s a win for the stars-and-stripes however not a blowout by any means.

The win share isn’t that a lot better both. Over the previous 53 years from 1970-2022, worldwide shares had greater returns than U.S. shares 25 occasions. The U.S. inventory market had higher efficiency in 28 out of 53 years.

It looks like U.S. shares all the time outperform however that’s recency bias at work. The efficiency is cyclical identical to every thing else within the markets.

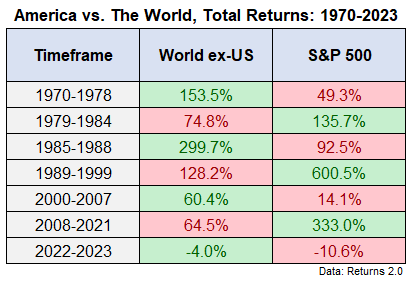

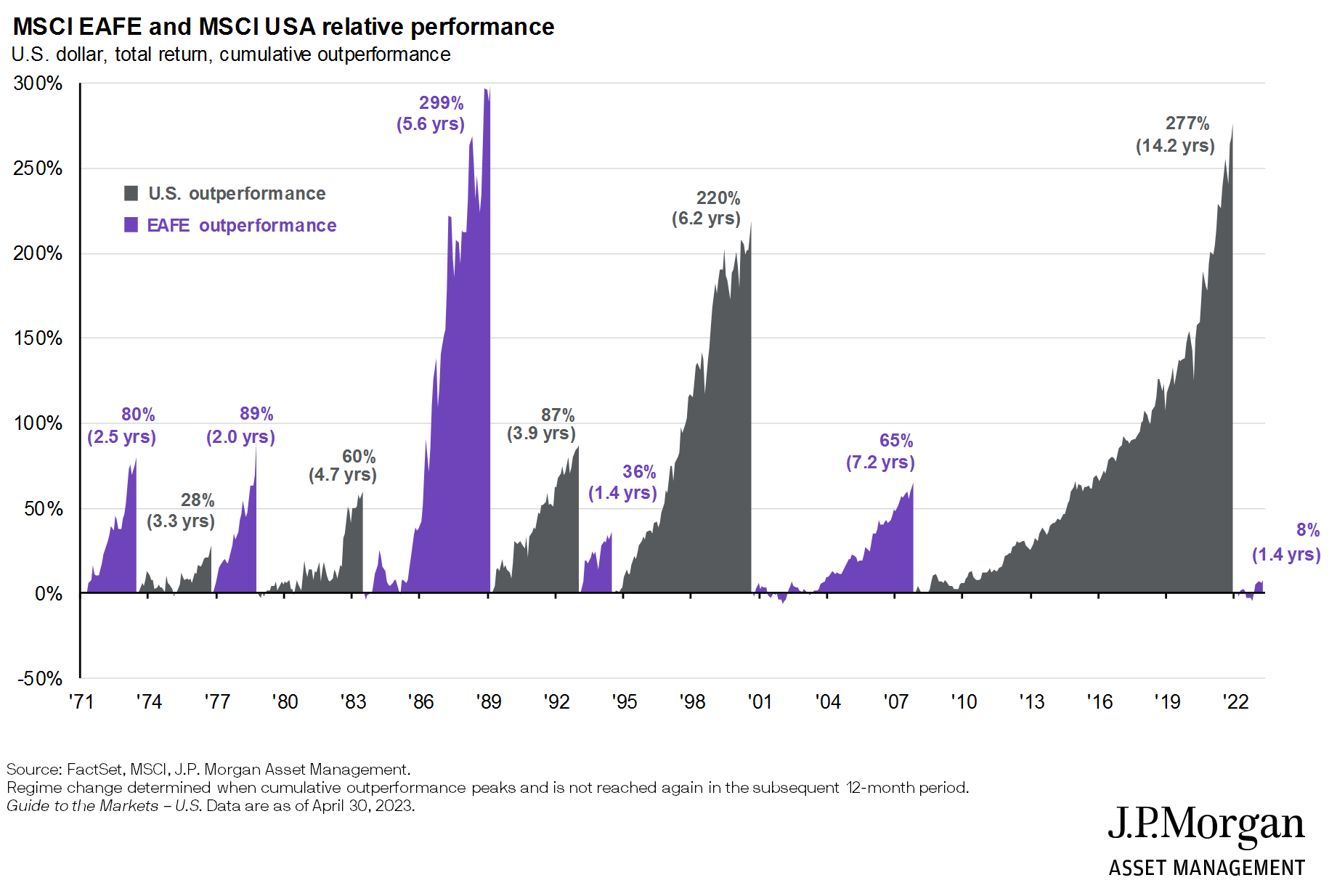

Listed below are whole returns by varied durations of over- or underperformance for every going again to 1970:

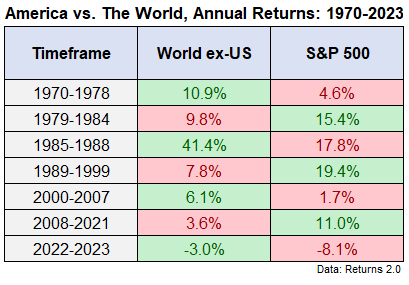

Some buyers have a better time wrapping their heads round annualized returns so listed below are these figures as effectively:

U.S. inventory had an unbelievable run popping out of the Nice Monetary Disaster however worldwide shares did much better at occasions within the Nineteen Seventies, Eighties and early-2000s.

It’s additionally true that a lot of the outperformance has taken place throughout the newest cycle. From 1970-2012, the annual returns have been principally lifeless even:

- U.S. shares +9.7%

- Worldwide shares +9.6%

The entire outperformance has basically come since 2013.

One factor that jumps out is the magnitude and size of outperformance by U.S. shares since 1990 or so.

This JP Morgan chart does a pleasant job of visualizing the size of relative efficiency over time:

AQR simply put out a brand new analysis piece that appears on the reasoning behind the relative energy of U.S. shares over the previous 30+ years:

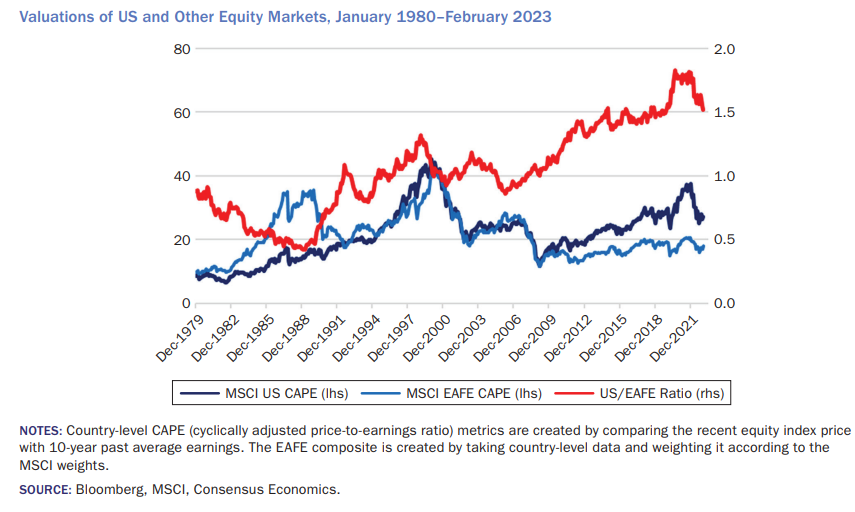

Since 1990, the overwhelming majority of the US’s outperformance versus the MSCI EAFE Index (forex hedged) of a whopping +4.6% per 12 months, was as a result of adjustments in valuations. The offender: In 1990, US fairness valuations (utilizing Shiller CAPE14) have been about half that of EAFE; on the finish of 2022, they have been 1.5 occasions EAFE. When you management for this tripling of relative valuations, the 4.6% return benefit falls to a statistically insignificant 1.2%.

Right here is the visible illustration of those phrases:

Mainly, worldwide shares went from comparatively costly (hiya Japan) to comparatively low cost and U.S. shares went from comparatively low cost to comparatively costly.

May this proceed? Perhaps.

Would I wager my life (or portfolio) on it? Most likely not.

I like AQR’s conclusion on whether or not or not worldwide diversification continues to be price it regardless of the underperformance in latest a long time:

Worldwide diversification continues to be price it, even when it hasn’t delivered for US-based buyers in 30 years. A lot of the US fairness outperformance throughout this era displays richening relative valuations, hardly a cause for elevating and even retaining US overweights at the moment. If something, traditionally broad relative valuations level the opposite approach. Right this moment is an unusually dangerous time to take the improper classes from the previous. Sadly, not often has doing the precise factor been so onerous (and it’s by no means simple).

Diversification is difficult since you simply know there may be all the time going to be one thing in your portfolio that’s going to underperform. You simply don’t know what that asset class or technique will probably be at any given time.

That’s a function, not a bug of spreading your bets with regards to portfolio administration.

It’s actually potential your portfolio could be effective over the long-haul investing completely in U.S. shares from present ranges.

Nevertheless it’s additionally extremely possible U.S. shares will underperform worldwide shares, probably for an prolonged time period.

When you may predict the longer term there could be no cause to diversify however nobody has the flexibility to know what comes subsequent within the markets or international economic system.

All investing entails trade-offs.

Diversification is about giving up on the flexibility to hit a grand slam so that you don’t strike out on the plate.

International diversification is about accepting ok returns to keep away from the potential for awful returns at an inopportune time.

Additional Studying:

Diversification Isn’t Undefeated Nevertheless it By no means Will get Blown Out