If you’re planning to purchase a time period life insurance coverage coverage, what’s the biggest concern you’ve got?

Your biggest concern almost definitely is: Whether or not the insurer will settle the declare on my demise?

And this query is essential as a result of if the insurer doesn’t pay the declare, all of the premiums paid go waste. Extra importantly, if the insurer rejects the declare, your loved ones can face severe monetary issues. Take into consideration your excellent house mortgage. Or youngsters’ training. Or mother and father’ wellbeing.

Due to this fact, as a potential purchaser, you’d wish to assuage such considerations, wouldn’t you?

How do you cut back possibilities of declare rejection?

Nicely, there are two methods.

- Decide up an organization that has document of settling life insurance coverage claims AND

- Don’t give any probability to the life insurer to reject your declare. You do that by making full medical disclosures whereas buying the plan.

We’ll come to (2) within the later a part of this submit. Let’s deal with (1).

For (1), we will take a look at the previous claims settlement knowledge of life insurance coverage corporations. If an organization has claims cost document, you may anticipate it to proceed the great document. Sure, there is no such thing as a assure. Nevertheless, it’s nonetheless a better option than an organization with a foul declare settlement document. Agree?

In January 2022, IRDA, the insurance coverage regulator, printed the declare settlement knowledge for all times insurers for FY2020-2021. Let’s take a look at the information and see what it tells us.

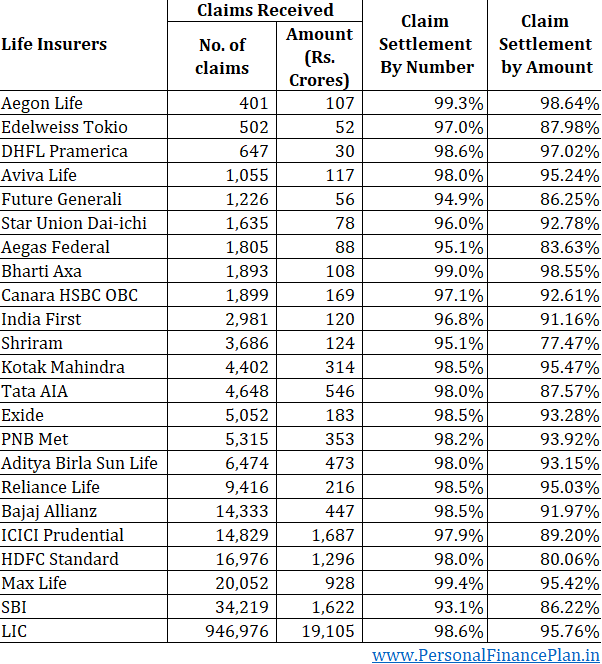

Declare Settlement Ratio of Life Insurance coverage Firms (FY2020-2021)

A 95% declare settlement ratio means the corporate settled 95 out of each 100 claims acquired.

Clearly, larger the higher.

All however 2 corporations report claims settlement ratio of 95% or extra.

14 out of 23 corporations boast of a settlement ratio larger than 98%.

3 corporations report greater than 99%.

That’s good.

However there’s a drawback. Generally, the numbers can cover greater than they reveal.

This knowledge is for every type of life insurance coverage insurance policies mixed.

What if the insurance coverage firm is settling low worth claims (in ULIPs or conventional plans) however rejecting excessive worth claims (in time period insurance coverage)?

And that’s attainable. In spite of everything, the declare quantity is a a lot larger a number of of annual premium within the case of time period insurance coverage. As an illustration, a premium of 12K-15K every year can get you a time period life cowl of Rs 1 crore. Sum Assured is 600-700X annual premium. Due to this fact, the insurance coverage firm (or the reinsurer) should pay a a lot larger quantity from its pocket in case of time period plans.

Distinction this with conventional life insurance coverage and ULIPs, the place because of the tax guidelines and product construction, the Sum Assured often is 10X annual premium.

With such economics, you’d anticipate the life insurance coverage corporations NOT to pay claims fortunately in case of time period insurance coverage. They’d examine extra and be keener to search out methods to reject claims.

Now, because you wish to purchase a time period life insurance coverage plan, you’d wish to know the declare settlement document for time period insurance coverage. Sadly, neither IRDA nor the life insurance coverage corporations present such knowledge.

Happily, we’ve a proxy. The IRDA annual report supplies declare settlement knowledge by profit quantity too.

Claims Settlement Ratio by Profit Quantity (FY2020-2021)

Let’s say a life insurance coverage firm receives 1000 claims in a yr. It approves 990 claims and rejects 10 claims.

Declare settlement ratio by quantity= 990/1000 = 99% (That’s good)

Now, let’s say, out of those 1000 claims, 950 claims have been from conventional plans and ULIPs. And the remaining 50 claims have been from time period plans.

Let’s additional assume that 950 claims have been Rs 5 lacs every. And the time period plan claims have been Rs 1 crore every. The insurance coverage firm settles 100% of 950 claims from conventional plans and ULIPs however settles solely 80% of the claims (40 out of fifty) in time period plans.

If we take a look at the declare settlement ratio by quantity, the declare settlement ratio remains to be 99%.

Nevertheless, if we take a look at the declare settlement by profit, the quantity is way decrease.

The insurance coverage firm acquired claims value 97.5 crores (950 x 5 lacs + 50 X 1 crore).

The insurance coverage firm settlement ratio value 87.5 crores (950 X 5 lacs + 40 X 1 crore).

Declare settlement ratio by profit quantity = 89.75% (this quantity doesn’t look good).

HDFC Life has a declare settlement ratio of 98% by quantity and solely 80% by profit quantity. Not good.

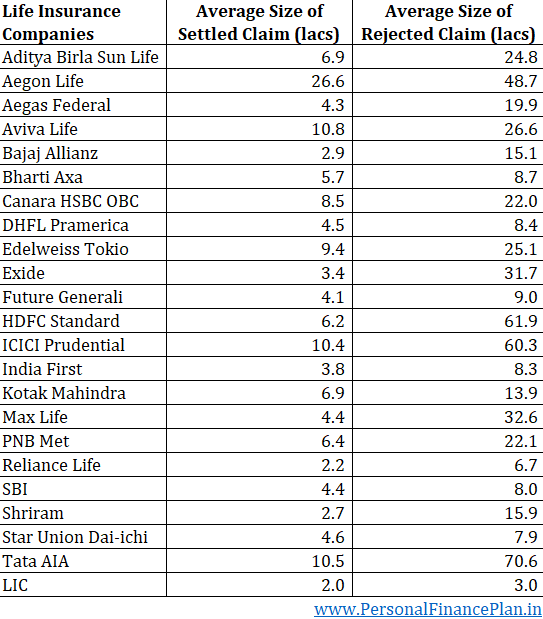

I additionally reproduce beneath the typical measurement of settled and rejected life insurance coverage claims (for particular person insurance policies) in FY2021.

You’ll be able to see the scale of common rejected claims is way larger than settled claims.

You must anticipate larger scrutiny of excessive worth claims however…

Sure, you have to anticipate larger scrutiny as a result of more cash is at stake. Furthermore, if one intends to defraud an insurance coverage firm, he’s possible to do that by shopping for a excessive worth coverage like a time period life insurance coverage plan. Nevertheless, it’s not clever to imagine that real instances usually are not rejected (the place there was no intent of fraud).

Why would real instances get rejected?

Due to materials non-disclosures.

If you don’t disclose your well being situations on the time of coverage buy, the underwriting crew can not value the coverage correctly and the insurer is justified in rejecting the declare (after it discovers about undisclosed situations).

Non-disclosure might be a case of omission. You neglect to share a well being situation with the corporate. Please don’t try this.

Or an act of fee. You intentionally cover particulars from the insurance coverage firm. No mercy for such patrons.

Nevertheless, I do know of instances the place the gross sales executives from insurance coverage corporations mislead and encourage patrons to not disclose sure situations as that would scale back possibilities of coverage issuance. That is dangerous judgement on a part of the client and the insurance coverage corporations share the blame. As a purchaser, you have to perceive that salespersons’ incentives are linked to the variety of insurance policies they promote. Not linked as to if the declare on the coverage bought was settled or rejected.

You’ll be able to’t blame the life insurance coverage firm for rejecting claims for non-disclosures

If an organization says they obtained too many fraudulent claims (or non-disclosure claims), please don’t purchase the argument.

How is it attainable {that a} specific firm is getting greater than its share of fraud and non-disclosure instances? Why would patrons cover attempt to defraud or cover their well being situations solely from that insurance coverage firm? Is senseless, proper?

If a selected insurance coverage firm has a historical past of low declare settlement ratios by profit quantity, it’s an indictment of their gross sales practices and their declare settlement tradition.

You’ll be able to overview my posts on Declare settlement ratio of life insurers within the earlier years. FY2016 FY2018

Purchase the time period insurance coverage plan from an insurer with greater than 98% declare settlement ratio by quantity and greater than 95% (or at the very least 90%) declare settlement ratio by profit quantity. Moreover, deal with the pattern. If there’s a sharp divergence between the two declare settlement ratios for an organization for a few years, you’ve got a purpose to be skeptical of such life insurer.

Don’t change into complacent due to Part 45 of the Insurance coverage Act, 2015

As per Part 45, a life insurance coverage declare can’t be rejected in case your insurance coverage coverage is over 3 years previous. Thus, even in the event you hid a medical situation from the insurance coverage firm on the time of buy, the insurance coverage firm has 3 years to search out out about non-disclosure. After three years, the coverage can’t be rejected on grounds on non-disclosure.

Whereas that is comforting, don’t change into complacent. Two causes for this.

- The demise can occur earlier than completion of three years, through which case the declare will possible be rejected, and your loved ones shall be left excessive and dry.

- Even when the demise occurs after 3 years, the insurance coverage firm can reject the declare on some grounds and pressure you to method the ombudsman or the courts. Whereas Part 45 tilts the stability in your favour, you may by no means be sure of the case end result. Furthermore, the delay within the declare settlement and authorized prices will burden your loved ones.

At all times bear in mind, even an organization with 99.5% declare settlement ratio by quantity has rejected 0.5% of the claims. If you’re NOT diligent, you could possibly fall in these unfortunate 0.5% of the rejected declare purposes. And an organization with 95% settlement ratio settles 95% of the claims. Your case might be in these 95% settled claims.

Time period Life Insurance coverage are easy

Time period life insurance coverage have only one insured occasion. Demise of the coverage holder. In contrast to a medical health insurance plan the place there might be disconnect between whether or not a selected remedy is roofed or not, the insured occasion in a time period insurance coverage plan is moderately goal. It’s tough to have a distinction of opinion over whether or not an individual is lifeless or alive. Due to this fact, the one reason behind rejection might be that you simply didn’t make correct disclosures (medical or monetary) on the time of coverage buy.

Therefore, make full well being (and monetary) disclosures whereas buying a life insurance coverage plan. You don’t resolve what info is materials or not. Let the insurance coverage firm resolve that.

Keep in mind you gained’t be round to contest any flaws in your utility. Your loved ones should struggle it out. Solely the insurance coverage corporations have entry to the “recorded strains,” not your loved ones. How will they contest the claims of the insurance coverage firm?

Due to this fact, in case you are shopping for the coverage over cellphone and disclose your well being situations to the gross sales government, make it some extent to share the identical info with the insurance coverage firm over an e-mail too. Copy such emails to a member of the family too. And guarantee these well being situations are captured within the proposal type hooked up together with your coverage.

The insurers challenge the insurance coverage insurance policies in good religion since there’s numerous info asymmetry. You realize way more about your well being than the insurer does. Hold your finish of the discount.

The submit was first printed in February 2022.