It’s not tough to discover a bearish perspective throughout a bear market.

The unhealthy stuff will get amplified and feels a lot worse when buyers are dropping cash.

Though shares have rallied this 12 months we’re nonetheless properly beneath the highs and stay in an financial atmosphere that’s more and more onerous to handicap.

Nassim Taleb has by no means been shy about voicing his bearish prognostications. The Black Swan writer stated in a current interview with Bloomberg, “Disneyland is over, the kids return to high school. It’s not going to be as clean because it was the final 15 years.”

I might push again in opposition to the notion that the final 15 years have been clean crusing for buyers however Taleb’s level is that larger rates of interest and inflation imply the inventory market continues to be overvalued and the street again to regular could possibly be painful.

Possibly he’s proper.

It’s not out of the strange for intervals of above-average returns to guide into intervals of below-average returns.

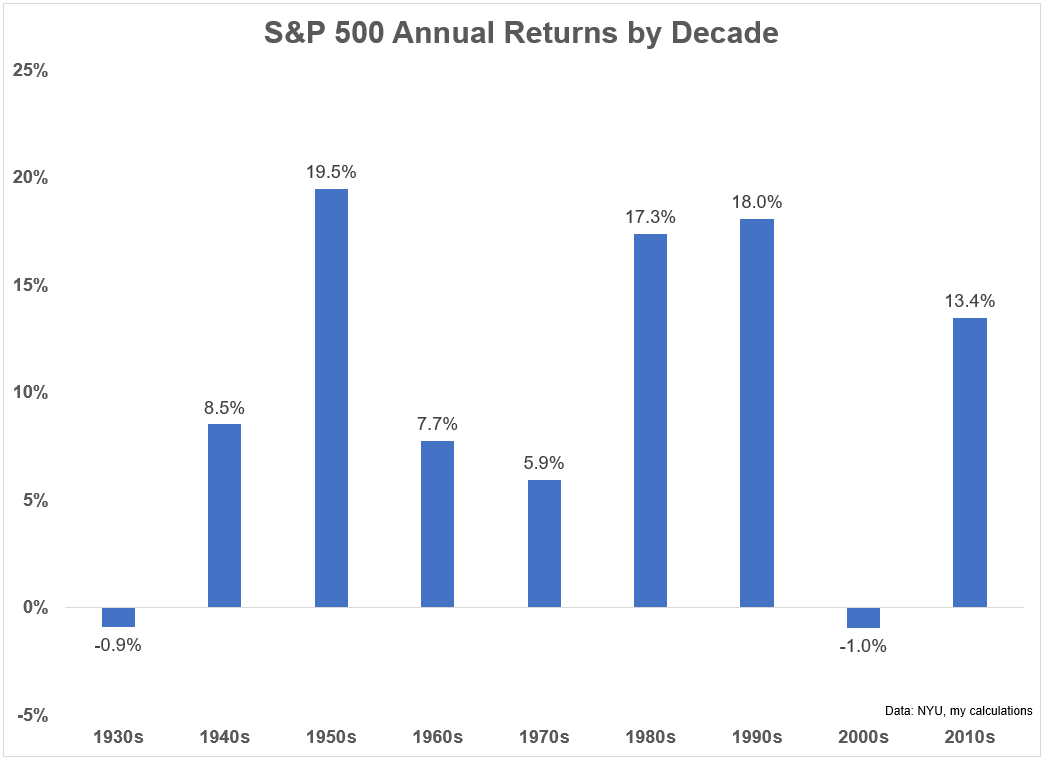

Simply have a look at annual returns by decade for the U.S. inventory market going again to the Nineteen Thirties:

Cycles don’t begin and cease each 10 years however these efficiency numbers do an excellent job at displaying the boom-bust nature of the inventory market.

Some many years gave buyers extraordinary returns (Fifties, Eighties, Nineties the 2010s) whereas others left quite a bit to be desired (Nineteen Thirties, Nineteen Seventies and 2000s).

The returns themselves don’t inform the entire story although.

A number of it is dependent upon the place you might be in your investor lifecycle.

There are specific environments which can be unbelievable for many who are absolutely invested however not all that nice for people who find themselves saving frequently and vice versa.

Let’s have a look at a really fundamental instance that helps present what I imply right here.

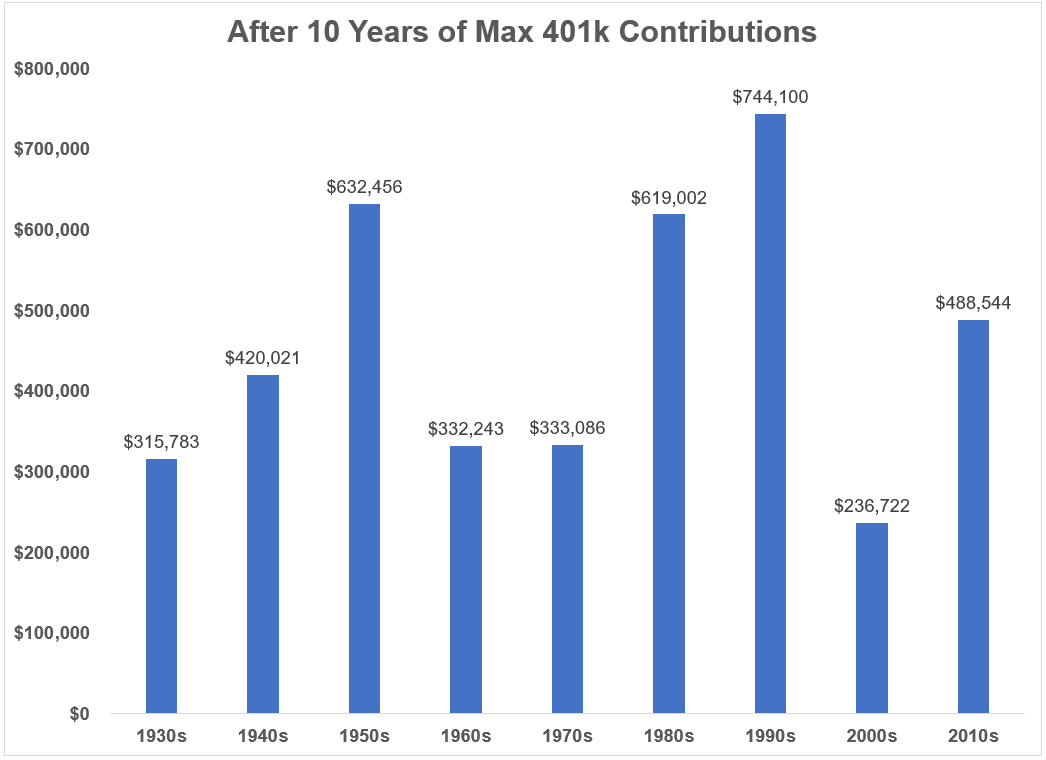

The utmost annual contribution it can save you in your 401k is now $22,500 which is up from $20,500 in 2022.1

See, inflation has some silver linings.

I took that annual contribution and utilized it to the returns for every of the previous 9 many years to indicate the portfolio balances after 10 years of saving cash within the U.S. inventory market (S&P 500):

Investing throughout the Nineteen Thirties and 2000s led to suboptimal outcomes. Investing within the Fifties, Eighties or Nineties led to phenomenal leads to only a decade’s time.

These outcomes make sense within the context of the annual returns for every decade.

However what if we seemed even additional out to see how these authentic 10 years’ price of financial savings carried out going additional out?

I’m going to offer an unrealistic instance right here however I’m doing so to make some extent so bear with me.

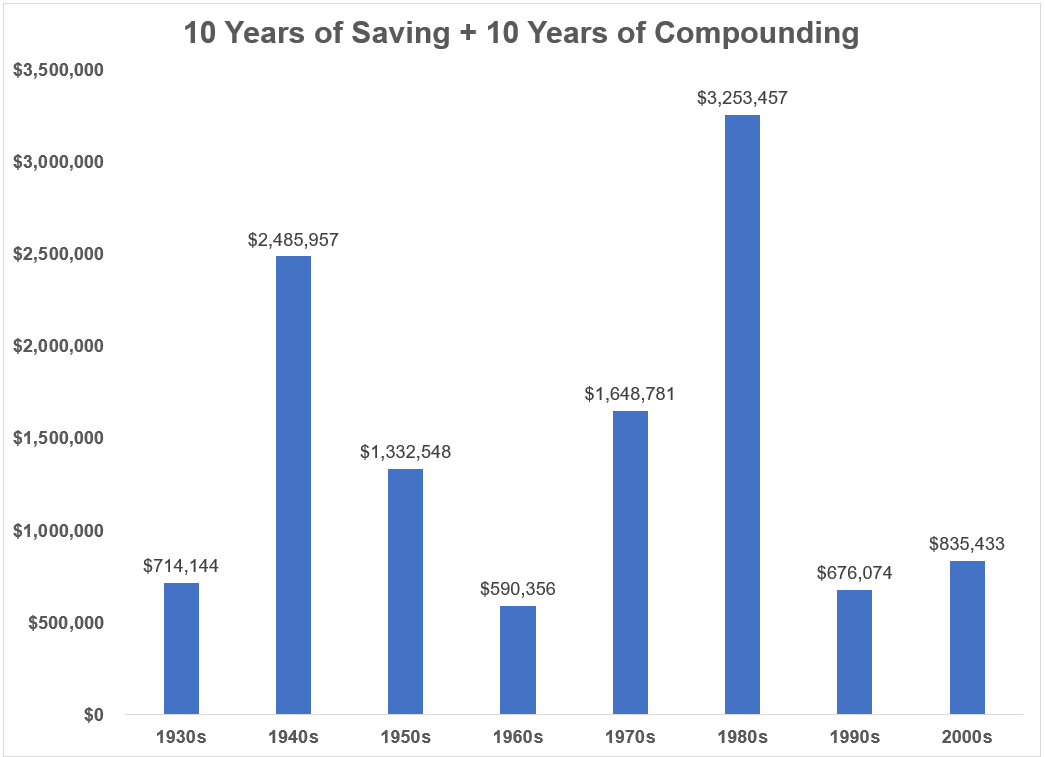

Let’s persist with those self same ending values after 10 years of maxing out your 401k and assume you cease making additional contributions. Now let’s see how issues shake out while you add an extra 10 years of returns within the following decade:

The Nineties went from the highest performer to second to final.

Why?

Since you would have been saving cash in a market that just about by no means went down for a decade solely to observe it up with a misplaced decade in U.S. shares within the 2000s. The same factor occurred to a Fifties saver.

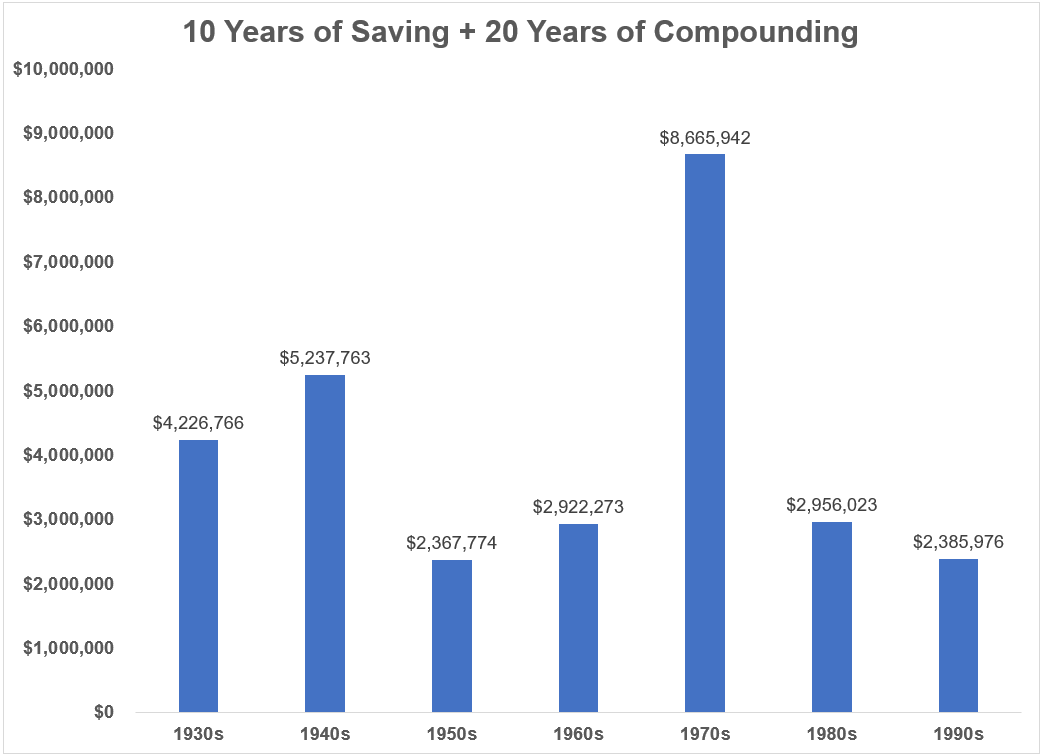

Now let’s add another decade to the combination so we now have an preliminary 10 years of max contributions adopted by 2 many years of compounding within the inventory market:

These outcomes don’t match up with the unique 10 years in any respect.

The Nineteen Seventies was one of many worst many years ever for buyers nevertheless it was a beautiful time to be a saver.2

You had a whole decade of volatility to place cash to work at decrease costs adopted by one of many biggest 2-decade bull markets of all-time.

The Nineteen Thirties had been the same story.

It was a dreadful time to be an investor however an superior time to be a saver. You had been capable of put your cash to work at generationally low costs. You needed to be extraordinarily affected person to see the fruits of your labor however by the point the post-WWII growth hit you had been handsomely rewarded.

The Fifties and Nineties are neck and neck for the very best many years buyers have ever seen. However in case you began saving in these many years your outcomes weren’t almost pretty much as good as different beginning factors as a result of the returns following these many years had been underwhelming.

Beginning within the Eighties looks like top-of-the-line beginning factors in historical past however ended up on the similar place because the Sixties. The Forties was a middle-of-the-road start line however completed robust.

Once more, this isn’t a method anybody of their proper thoughts would make use of. Most individuals can’t max out their 401ks annually and nobody saves for 10 years after which stops.

However this information goes to indicate that the very best time to be an investor not often traces up with the very best time to be a saver.

The Black Swan man is perhaps proper. We could possibly be organising for a painful time for buyers. It’s at all times a chance.

A painful time for buyers is an excellent time for savers. That’s while you construct a base at decrease costs. Volatility is your good friend in case you are saving cash frequently and outline your time horizon in many years versus months or years.

It’s additionally essential to grasp how a lot luck is concerned within the timing of your lifecycle as a saver and investor.

You’ll be able to’t management the timing of bull or bear markets.

You’ll be able to management how a lot you save, your stage of diversification, the funding bills you pay and the way lengthy you keep invested.

I can’t assure the longer term might be just like the previous. However even the worst final result over 30 years would have turned low 6-figures saved into 7-figures within the inventory market in my simplified instance.

Saving and investing cash frequently whereas considering and performing for the long-term stays the very best technique for the overwhelming majority of buyers.

Additional Studying:

Surviving a Bear Market When You’re Finished Saving

1I’m ignoring the corporate match right here in fact. You may as well sock away an additional $7,500 (up from $6,500 in 2022) in case you’re 50 or older.

2I may have adjusted these returns for inflation however the level right here is to not present the very best decade. The purpose is to indicate how the timing of returns can influence your outcomes relying on the place you might be in your investing lifecycle.