The Monetary Occasions had a narrative this week about Carl Icahn’s bets towards the inventory market that went awry.

Since 2017, Icahn has been positioning a part of his portfolio for an enormous crash. It value him practically $9 billion over the previous 6 years.

Feels like rather a lot.

Right here’s what he instructed the Occasions:

“I’ve at all times instructed folks there’s no person who can actually decide the market on a short-term or an intermediate-term foundation,” Icahn instructed the FT in an interview to debate the evaluation. “Possibly I made the error of not adhering to my very own recommendation lately.”

At instances, Icahn’s notional publicity, the underlying worth of the securities he was betting towards, exceeded $15bn, regulatory filings present. “You by no means get the proper hedge, but when I saved the parameters I at all times believed in . . . I’d have been high-quality,” he stated. “However I didn’t.”

Good on him for admitting his mistake.

Though, he did comply with the tried and true portfolio supervisor excuse that when all else fails blame the Fed:

“I clearly believed the market was in for nice hassle,” Icahn stated. “[But] the Fed injected trillions of {dollars} into the market to struggle Covid and the outdated saying is true: ‘don’t struggle the Fed’.”

And I’d have gotten away with it too, if it weren’t for you meddling youngsters!

I’m not making an attempt to dunk on Icahn. He’s a billionaire many instances over. He’ll be high-quality. You’ll be able to’t win ’em all, particularly when making an attempt to time the market.1

However there are some good investing classes in all of this.

Certain, the inventory market does crash occasionally however more often than not it goes up.

By my depend, there have been simply 13 bear markets since World Warfare II (together with the present iteration).

That’s one out of each 6 years or so, on common.

Throughout that very same timeframe, the inventory market has fallen by 30% or worse 4 instances.

That’s one out of each 13 years or so, on common.

A crash of fifty% or worse has occurred simply 3 instances.

That’s one out of each 26 years or so, on common.

Inventory market returns are something however common but it surely’s true that calamities within the inventory market are rarer than you suppose.

The crash state of affairs is at all times going to sound extra interesting narrative-wise however the upside vastly outweighs the draw back within the inventory market.

Having a adverse bias towards the market 12 months after 12 months after 12 months is a low-probability wager.

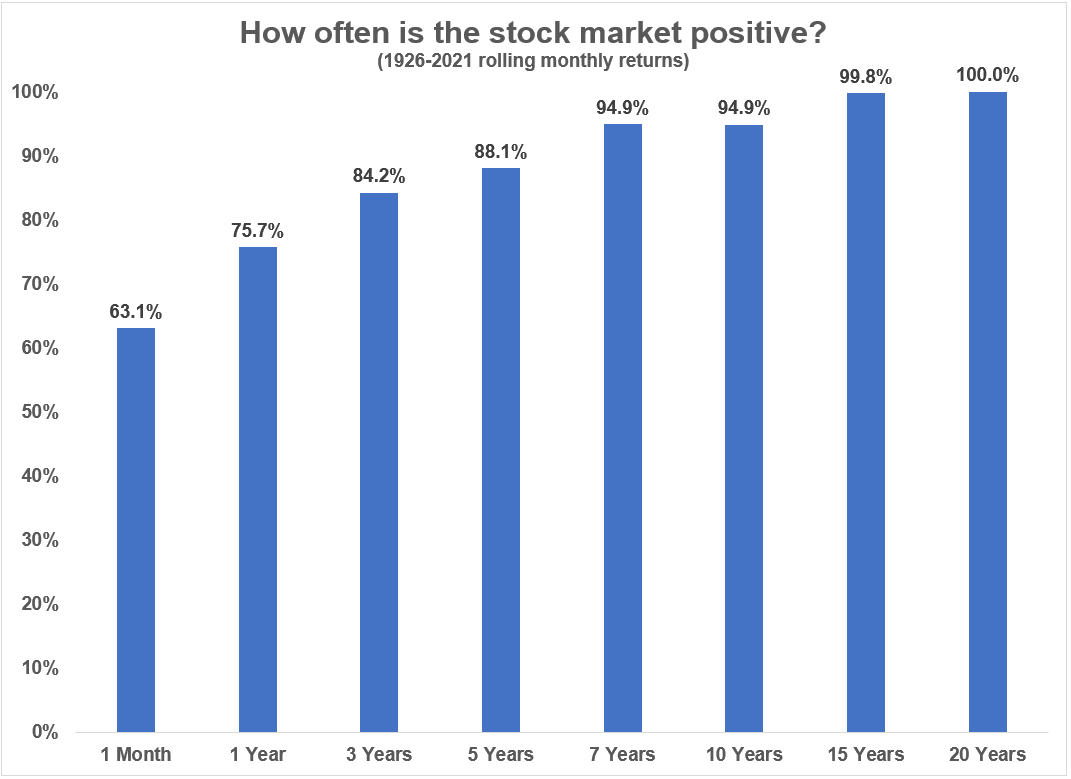

I’ve proven the info many instances within the previous in regards to the historic monitor report of positive aspects vs. losses over numerous time frames but it surely bears repeating.

Since 1926, the U.S. inventory market has skilled optimistic returns:

- 56% of the time every day

- 63% of the time on a month-to-month foundation

- 75% of the time on a yearly foundation

- 88% of the time on a 5 12 months foundation

- 95% of the time on a ten 12 months foundation

- 100% of the time on a 20 12 months foundation

Can I assure these win charges sooner or later? After all not! There are not any ensures on the subject of the inventory market.

However betting on a crash sounds clever till you notice (a) how tough it’s to foretell the timing of a bear market and (b) how usually the inventory market usually goes up over time.

The inventory market has crashed previously and it’ll crash sooner or later.

It’s simply that nobody, regardless of how wealthy they’re, can predict when it’s going to occur.

It is smart to arrange for draw back danger within the inventory market but it surely’s not possible to foretell it forward of time.

And it’s additionally vital to arrange for upside within the inventory market as a result of more often than not it goes up.

Additional Studying:

Why Does the Inventory Market Go Up Over the Lengthy-Time period?

1I additionally discover it attention-grabbing what number of legendary gray-haired traders flip into perma-bears later in life. Buffett is principally the one older investor who remains to be optimistic in regards to the future.