1) Comfortable Touchdown, Laborious Touchdown, No Touchdown? The COVID years simply get weirder and weirder. The COVID hangover is very bizarre. We’ve all been hoping for inflation to decelerate, nevertheless it stays stubbornly excessive. In the meantime the economic system is decelerating throughout the board, however stays…surprisingly robust.

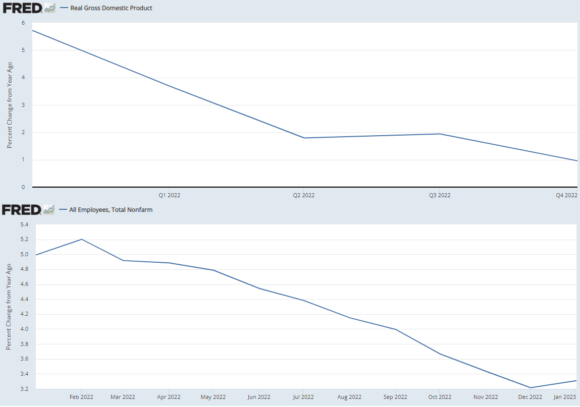

You see it in nearly all the info. For instance, beneath is a chart of Actual GDP and payroll development on a one yr foundation. You’ve had a fairly important slowdown in each. However they’re not going unfavourable!

So now persons are beginning to discuss in regards to the “no touchdown” situation – a state of affairs during which the aircraft simply continues to fly with out ever touchdown.

Personally, I nonetheless assume this has an extended methods to go. The maths on the economic system isn’t that sophisticated for my part. When mortgage charges went over 5% the housing market floor to a halt. And so with mortgage charges at 6.75% as I write we’re nonetheless in an surroundings the place housing is more likely to stay very challenged. And so long as housing stays weak the broader economic system will stay weak and fragile. So yeah, possibly the aircraft isn’t going to crash, however as I said in my 2023 outlook the potential for a “muddle by” yr appears just like the most certainly end result right here and I wouldn’t let a couple of good information factors cloud the larger image right here.

2) The Secret Sauce of ETFs is Nonetheless a Secret

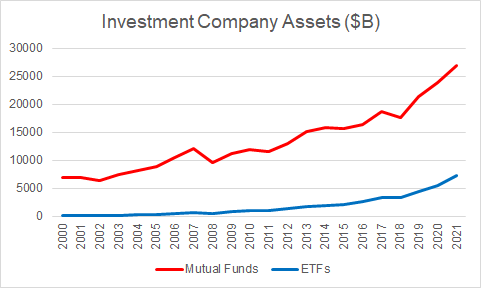

Once we speak about massive massive traits within the asset administration area the ETF vs mutual fund battle must be one of many absolute greatest. I keep in mind again within the early 2000s I used to be at Merrill Lynch and we solely used mutual funds. This was when ETFs have been simply turning into a factor and I might always examine the mutual funds we used to comparable ETFs. I’d examine the relative efficiency, charges, tax effectivity and the ETFs nearly at all times got here out on high. And I keep in mind asking somebody within the ML coaching program why we don’t simply use ETFs. The reply was at all times “we don’t receives a commission to promote low value index funds”. I by no means understood this and I’ve continued to be amazed at how sticky the mutual fund product wrapper is when it’s a lot worse in so some ways (liquidity, prices, tax effectivity, and so on).

So it’s nonetheless type of wonderful to see the relative dimension of the ETF vs mutual fund area, 20 years later, and be aware that the ETF area continues to be dwarfed by mutual funds.

I’m principally the anti-Bogle on the subject of this matter. Whereas he mentioned ETFs have been horrible I believe they’re maybe one of the best innovation within the funding world within the final 30 years. However the issue is that lots of people nonetheless don’t perceive them. And the factor that’s most misunderstood is their inherent tax effectivity and the way in which ETFs might help you defer taxes. That is very true inside, ahem, the multi-asset fund of funds construction the place you possibly can rebalance to a sure threat profile INSIDE a single ETF utilizing inventory AND bond funds with out essentially incurring capital good points taxes alongside the way in which. As Meb Faber notes on this Tweet, the distinction isn’t small. ETFs can add as a lot as 0.7% per yr in tax effectivity alone.

The annoying factor is that this secret sauce isn’t actually a secret. It’s a scrumptious recipe on the market in broad public for everybody to client and but it’s a recipe that doesn’t appear to essentially catch on….

3) Don’t Fear In regards to the Curiosity on the Nationwide Debt

We printed a brand new 3 Minute Macro video during which we talk about the chance of curiosity on the nationwide debt. It is a query I’ve gotten 1,000,000 instances through the years and the conspiracy theorists simply find it irresistible as a result of it appears so intuitive.

The essential pondering is {that a} surge within the nationwide debt mixed with rising rates of interest creates the chance of a suggestions loop the place the federal government has to pay a lot curiosity that it creates excessive inflation which feeds on itself. Sounds scary, nevertheless it’s not likely that scary in actuality.

As I clarify within the video, the scale of the curiosity funds actually isn’t that massive in comparison with historic funds and there are different way more vital elements at play right here. Please test it out and I hope you be taught one thing new from the video.