This 12 months’s federal tax deadline is Tuesday, April 18, 2023. If you happen to can not get your tax return collectively earlier than this date, you possibly can file a tax extension request to keep away from late submitting penalties (though your tax {dollars} are nonetheless due by this date).

For instance, you may be navigating a precarious life occasion, dwelling abroad, or ready for these last year-end tax paperwork resembling a Schedule Ok-1 or a corrected Type 1099. Life occurs, however the tax collector nonetheless desires their justifiable share.

Realizing find out how to get a tax extension on-line can relieve stress when you owe revenue taxes this 12 months.

Fortunately, the tax extension course of is comparatively easy, though there are some things to know with a purpose to keep away from tax penalties and curiosity.

Desk of Contents

What Is a Tax Extension?

A tax extension is a six-month grace interval to finalize your tax return with out late submitting penalties. People and companies can submit a tax extension type on-line or by mail.

People who submit IRS Type 4868 earlier than the extension deadline gained’t pay a Failure to File penalty, which is 5% of their unpaid month-to-month taxes (as much as a most of 25% after 5 months of not submitting).

Nonetheless, you have to nonetheless pay your estimated revenue tax due on or earlier than the federal tax deadline to keep away from late penalties and curiosity in your tax legal responsibility.

Luckily, paying 90% of your taxes due will waive any late penalties and curiosity whenever you submit the remaining quantity due together with your return.

Tax Extension Submitting Deadlines

There are two necessary dates to recollect when you want extra time to file your taxes:

- April 18, 2023: You should submit your tax extension request earlier than the federal IRS tax deadline. Usually, the IRS tax deadline is April fifteenth though it falls on April 18, 2023, this 12 months because of the 15th touchdown on a Saturday and the District of Columbia’s Emancipation Day being on Monday the 17th.

- October 16, 2023: You’ve got till this date to submit your tax return to keep away from a Failure to File penalty. As an FYI, the standard extension deadline is October 15th, but it surely falls on a Sunday this 12 months. The IRS strikes it to the following enterprise day when the 15th is on a Saturday, Sunday, or a authorized vacation.

This 12 months’s tax extension deadlines are distinctive, as the usual tax submitting deadlines are on the weekend this 12 months. Subsequently, you’ve gotten an extra reprieve till the following enterprise day.

Study Extra: What occurs if I don’t file my taxes?

Do I Have to File a Tax Extension?

You should file a tax extension when you anticipate owing revenue taxes however don’t have all the mandatory particulars and kinds to submit an correct tax return earlier than the deadline.

Nonetheless, submitting an extension is pointless when you get a tax refund, as you gained’t owe the IRS cash. However there’s nothing unsuitable with submitting a type as a safeguard simply in case you obtain an sudden tax invoice.

Tax Extension Exemptions

The next taxpayers might be excused from submitting a tax extension earlier than the mid-April deadline:

- Catastrophe victims: The IRS maintains a listing of disaster-related tax aid, together with delayed submitting deadlines. For instance, filers in choose states could have till Might 15.

- Fight zone service: Members of the U.S. Armed Forces and eligible civilians in fight areas are exempt from the usual submitting and extension timelines. You will get the particular particulars from IRS Publication 3.

- Residing abroad: Navy households and civilians dwelling or working exterior the USA or Puerto Rico might be eligible for an automated 2-month extension. Nonetheless, you have to connect a press release to your return to state your purpose. The shape is pointless when you don’t have to file a tax return.

As a reminder, a tax extension waives the failure to file a penalty, however you’re nonetheless answerable for paying your revenue tax due. The extension type has a field to estimate your revenue tax owed, so you possibly can submit fee if required.

Tips on how to File for an IRS Tax Extension On-line

Here’s a step-by-step have a look at how one can submit your tax extension electronically.

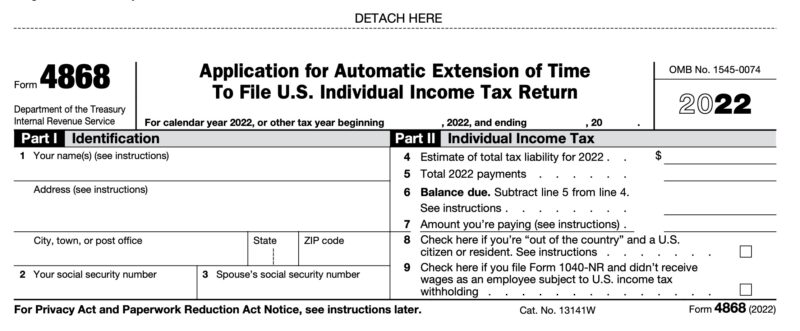

Full IRS Type 4868

Particular person taxpayers will full Type 4868, though there’s a unique type for enterprise or company revenue tax returns.

Type 4868 is brief and easy to finish, though you need to full as a lot of your return as potential to estimate your tax legal responsibility. Meaning calculating your adjusted gross revenue, tax deductions, and tax credit to one of the best of your capacity.

Fortunately, you possibly can obtain assist to file for an extension:

- IRS Free File: The IRS Free File Program lets households with an adjusted gross revenue (AGI) under $73,000 put together their taxes with guided assist without charge. This program additionally gives free fillable kinds for all federal revenue tax brackets.

- On-line tax software program: The finest tax software program applications, resembling TurboTax and H&R Block, can effortlessly generate this type.

- Tax preparer: If you happen to rent an area Enrolled Agent (EA) or a Licensed Public Accountant (CPA) to organize your tax return, they will full this type as nicely.

Any of the above strategies can assist you put together your return throughout tax season, file for an extension, pay your estimated taxes, and finalize your return in the course of the six-month extension interval.

Submitting your extension on-line is normally the quickest and easiest way. You possibly can anticipate receiving a affirmation e-mail inside 24 hours so you understand your request is accredited, offering further peace of thoughts.

After submitting the extension, you’ve gotten till October 16, 2023, to file your return.

An Exception to the Rule

One group of taxpayers that should mail of their tax extension kinds are those that pay by the fiscal 12 months. Practically each family follows the calendar 12 months schedule (January 1 to December 31), so this restriction is a non-issue however is price mentioning.

If you happen to determine to mail in your extension, the IRS type lists the mailing deal with on your state. As a forewarning, there’s a separate deal with if you can be sending fee versus simply the shape.

Pay Your Estimated Tax Quantity

You should pay at the least 90% of your last legal responsibility earlier than the federal tax deadline to keep away from the late fee penalty.

The extension type asks you to subtract your complete tax funds (up to now) out of your estimated complete tax legal responsibility. Any estimated taxes, employer tax withholdings, and job bonus taxes offset the remaining quantity due and depend towards the 90% requirement.

For instance, in case your last tax legal responsibility is $9,000, you have to pay at the least $8,100 by the federal tax submitting deadline to keep away from late fee penalties and curiosity. The penalty is 0.5% of the tax owed on April 18, 2023, and has a most penalty of 25%.

File Tax Return

Upon getting your entire affairs so as, you possibly can finalize your Type 1040 and ship it to the IRS earlier than the October submitting deadline.

If you happen to paid at the least 90% of your taxes due earlier than the usual deadline, your remaining steadiness is due together with your return to keep away from penalties and curiosity.

State Earnings Tax Extensions

Most states with an revenue tax will grant a six-month extension upon request for related causes as getting a federal tax extension. Examine together with your state tax company, tax prep software program, or tax preparer to finish the particular type and discover out your new tax return due date.

Tax Extension FAQs

No, any individual needing to file a tax return can request an extension without spending a dime. Nonetheless, it’s necessary to do not forget that a tax extension solely waives the late submitting penalty, however the vital revenue taxes are nonetheless due by the usual tax submitting deadline.

It’s free to file a tax extension request, though your tax software program or tax preparer. Nonetheless, you might have to pay for a 3rd occasion to organize your return in your behalf when you don’t qualify for a free tax service.

Sadly, the IRS solely grants one six-month tax extension. Your tax return is topic to a late submitting penalty if the October tax extension deadline is missed.

It’s higher to request an IRS tax extension on-line because the processing speeds are sooner and you may simply observe the progress of your request. Normally, on-line filers will obtain a affirmation e-mail inside 24 hours of sending their request on-line.

You will want to offer these primary particulars to file a tax extension:

– Authorized title

– Dwelling deal with

– Social Safety quantity (joint returns want their partner’s SSN too)

– Estimated revenue tax legal responsibility

Whilst you don’t want to offer a purpose for needing an extension, out-of-country residents might want to present an extra assertion to course of their request.

Last Ideas

Tax submitting season can not finish quickly sufficient for many of us, so you possibly can decide when you owe taxes or get a refund and may begin attaining your different monetary priorities. Typically, you want a bit of additional time to file your taxes, and a tax extension gives respiratory room.

Getting a tax extension on-line is simple, however you need to take note of the deadlines to keep away from further penalties and curiosity.