If that you must ship cash to a pal or obtain fee, likelihood is you’re utilizing PayPal or Venmo. Hundreds of thousands of individuals use these two fee apps to switch cash every single day. However whereas each platforms provide an identical service, and PayPal truly owns Venmo, there are some key variations.

For instance, PayPal operates internationally, whereas Venmo is simply obtainable in america. Venmo, however, is taken into account simpler to make use of and is extra prevalent amongst Gen Z (born in 1997 or later).

On this Venmo vs. PayPal comparability, I’ll evaluate the important thing options that will help you determine which peer-to-peer (P2P) fee service is healthier for you.

Desk of Contents

- Venmo vs. PayPal: At a Look

- Consumer Demographics

- What do PayPal and Venmo provide?

- Venmo and PayPal Enterprise Accounts

- Are PayPal and Venmo transactions taxable?

- What Is Venmo?

- The right way to Be a part of Venmo

- How Does Venmo Work

- Venmo Charges

- Including Cash to Your Venmo Account

- Withdrawing Funds from Venmo

- Cryptocurrency

- Venmo Mastercard Charges

- Venmo Debit Card

- Venmo Credit score Card

- What Is PayPal?

- The right way to Be a part of PayPal

- How Does PayPal Work?

- PayPal Charges

- Including Cash to Your PayPal Account

- Withdrawing Funds from PayPal

- Cryptocurrency

- PayPal Mastercard Charges

- PayPal Rewards

- PayPal Debit Card

- PayPal Credit score Card

- Why Venmo is Higher Than PayPal

- Why PayPal is Higher Than Venmo

- Venmo vs. PayPal: Remaining Ideas

Venmo vs. PayPal: At a Look

Here’s a fast comparability to spotlight the similarities and variations.

| PayPal | Venmo | |

|---|---|---|

| Appropriate Gadgets | Android, iOS, Net | Android, iOS, Net |

| International locations Obtainable In | Over 200 nations and 25+ supported currencies | United States solely |

| Account Varieties | Private and Enterprise | Private and Enterprise |

| Value to Be a part of | Free | Free |

| Charges | Ship cash to associates: Free for many strategies however 3% when utilizing a bank card. Receiving funds: Normally free however 2.99% plus a hard and fast price Items and Companies Withdrawing funds: Free (1-3 days) or 1.75% for Prompt Withdrawals. | Ship cash to associates: Free for many strategies however 3% when utilizing a bank card. Receiving funds: Normally free however 1.9% plus $0.10 for enterprise accounts and Items and Companies transfers. Withdrawing funds: Free (1-3 days) or 1.75% for Prompt Withdrawals. |

| Transaction Limits | Linked checking account: As much as $25,000 per transaction. Prompt transfers: As much as $5,000 per transaction and $15,000 monthly | Unverified accounts: $299.99 per week. Verified accounts: As much as $60,000 per week |

| Particular Options | Worldwide Transactions: Can switch cash overseas and make purchases from non-U.S. retailers. PayPal Rewards: Earn factors at on-line retailers for purchasing credit or money again. Fee Choices: Pays instantly by many on-line retailers. Rewards debit and bank cards can be found. | Social Feed: Work together with associates by social sharing updates. Venmo Debit Card: Free verify card to earn money again at taking part retailers and free in-network ATM withdrawals. Venmo Credit score Card: No annual price, earn as much as 3% again on purchases |

| Finest For | Worldwide transactions and receiving aspect hustle app funds | Diminished charges for purchases, user-friendly cell app, rewards debit card |

Consumer Demographics

The higher app might depend upon which one your pals and colleagues use. For instance, 83% of Venmo customers are youthful than 35 years, in comparison with roughly 48% of PayPal customers.

PayPal’s person base is older, however the fee platform dates again to 1999 as one of many first companies to settle on-line transactions between particular person patrons and sellers. Statista reviews that the biggest age group is from 50-64 years outdated, which is 29% of PayPal’s lively customers.

Moreover, PayPal has a considerably bigger buyer footprint consisting of 435 million customers in comparison with 83 million lively Venmo customers on the finish of 2022.

What do PayPal and Venmo provide?

You need to use each apps to finish the next duties:

- Ship cash to associates

- Pay for in-store and on-line purchases

- Commerce cryptocurrency

- Rewards bank cards and debit playing cards

- Private and enterprise accounts

It’s potential to switch funds without cost with each apps, however there are limitations, which I’ll cowl intimately a bit later.

Venmo and PayPal Enterprise Accounts

Each companies provide enterprise profiles, permitting you to offer clients with extra fee choices, whether or not you use domestically or on-line.

Venmo has a extra intuitive person interface, nevertheless it has limitations:

- Just one person per enterprise account

- No built-in invoicing instruments

- You can’t ship cash abroad (i.e., for those who rent out-of-country freelancers)

- Can solely ship as much as $25,000 per week with identification verification ($2,499.99 with out)

PayPal affords invoicing instruments and web site integration instruments that may make it simpler for purchasers to “Pay with PayPal.” It additionally helps worldwide transactions. Nonetheless, listed below are some drawbacks to beware about:

- The interface is clunkier and tougher to navigate

- Doesn’t have a social media feed to publicize your online business

- Transaction charges are larger (as much as 3.49% plus a hard and fast price vs. 1.9% + $0.10)

Are PayPal and Venmo transactions taxable?

Each platforms will generate a tax kind (1099-Okay) whenever you obtain not less than $600 per calendar yr in transactions labeled as items and companies. Vendor charges apply to those transactions as they qualify for purchaser and vendor safety advantages.

To keep away from tax reporting points and pointless charges, confirm your pals and select the Mates and Household choice. (This switch choice is simply obtainable in private accounts and can be utilized for issues like splitting purchases or sending cash as a present).

Solely the sender incurs charges on Household and Good friend cash transfers in the event that they use a bank card to fund it. To keep away from the price, use your Venmo steadiness or a linked checking account and debit card.

What Is Venmo?

Venmo was based in 2009 and bought in 2013 by PayPal. Its platform is geared towards in-app social interplay. In different phrases, it’s a fee app and social media platform beneath the identical umbrella.

For example, customers can have their transactions and personalised notes posted to a public feed seen to associates and companies. Don’t fear, you possibly can decide out of public sharing for those who want privateness.

This P2P app is a well-liked manner for associates to separate purchases when going out, though a lot of companies additionally settle for Venmo QR code funds, just like Sq. or Money App checkout kiosks.

The right way to Be a part of Venmo

You have to dwell inside america and be not less than 18 years outdated. This app can’t be used exterior of the USA right now. The app hopes to increase internationally sooner or later.

You’ll be able to be a part of Venmo through Venmo.com or obtain the Android or iOS cell app.

You have to at present be in america and have a telephone to obtain SMS textual content messages to hitch. The app additionally requires your full authorized title to confirm your identification.

As you create your profile, you possibly can hyperlink these accounts to fund transfers:

All customers should create a private account first. In the event you’re a freelancer or enterprise proprietor, you even have the choice of opening a enterprise profile to entry extra fee instruments.

In the event you haven’t joined but, you might qualify for a Venmo new account bonus. Usually, new customers can earn not less than $5 by making an eligible buy inside 14 days after linking their checking account or a fee card.

How Does Venmo Work

Essentially the most handy manner to make use of Venmo is thru its cell app, which is filled with options. For instance, it permits you to scan QR codes in-store to pay for purchases, saving you from having to tug out a bank card or debit card or paying with money.

Venmo’s desktop app can also be simple to make use of. You’ll be able to ship or obtain funds and schedule account transfers to extend your Venmo steadiness.

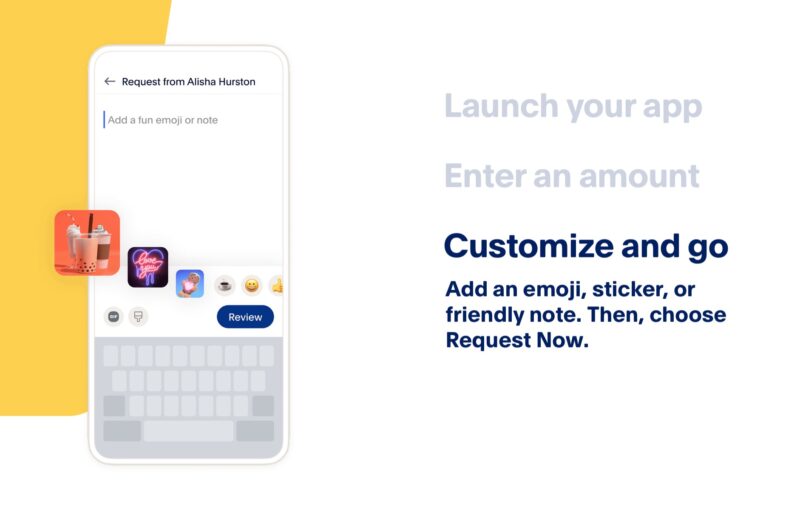

In the event you select to publicize your transactions, you possibly can sort out a personalised notice with emojis.

Receiving Funds

With Venmo, both occasion can request fee by the app. A built-in calculator makes it simple to separate purchases precisely earlier than sending your cash request. You can too have one other Venmo person scan your private QR code that seems in your telephone display screen upon request.

On-line Procuring

Whereas increasingly more on-line retailers are accepting Venmo funds, the record stays smaller than retailers with a PayPal checkout button.

A number of the hottest retailers embody:

- Boxed

- DoorDash

- Grubhub

- Lyft

- Poshmark

- Uber

- UberEats

You can too pay by a Venmo-issued debit card or bank card when the “Pay with Venmo” choice is unavailable.

Venmo Charges

It’s potential to make use of Venmo with out paying any charges to make purchases or to ship cash to associates.

Account Service Charges

- Account Setup: $0

- Month-to-month Service Charge: $0

Charges for Spending or Sending Cash

- On-line purchases: $0 (whatever the fee technique)

- Sending cash to associates out of your Venmo steadiness, checking account, or debit card: 0%

- Sending cash to associates out of your bank card: 3%

Including Cash to Your Venmo Account

You received’t incur charges when receiving cash from the next sources (excluding Items and Companies and enterprise/charity funds):

- Funds acquired in your private account from one other Venmo person

- Linked checking account

- Direct Deposit

- Service provider refunds

Cell verify deposits are topic to the next costs:

- 0%: When ready ten days to your funds to develop into obtainable

- 1% (minimal $5 price): Deposit clears inside minutes for pre-printed payroll and authorities companies checks

- 5% (minimal $5 price): “In minutes” deposits for non-payroll and non-government checks

Word {that a} flat price of 1.9% plus $0.10 applies to all funds acquired in enterprise profiles, charity, or Items and Companies transactions in a private profile.

Withdrawing Funds from Venmo

Transfers to your linked checking account are free however require 1-3 days to finish.

Prompt transfers that clear inside minutes to your debit card or checking account price 1.75% (minimal price of $0.25 and a most price of $25).

The next switch limits additionally apply:

- Unverified Accounts: As much as $999.99 in weekly withdrawals

- Verified Accounts: As much as $19,999.99 per week and $5,000 per withdrawal

Cryptocurrency

A price applies every time you purchase or promote cryptocurrency inside your account:

| Buy or Sale Quantity | Charge |

| $1.00 to $4.99 | $0.49 |

| $5.00 to $24.99 | $0.99 |

| $25.00 to $74.99 | $1.99 |

| $75.00 to $200.00 | $2.49 |

| $200.01 to $1,000.00 | 1.80% |

| $1,000.01 or extra | 1.50% |

Venmo Mastercard Charges

In the event you select to make use of the non-compulsory Venmo Mastercard debit card, the next charges apply:

- In-network ATMs (MoneyPass community): $0

- Non-network ATMs: $2.50

- Over-the-counter withdrawals (banks and monetary establishments): $3.00

There are not any charges to make purchases or verify your steadiness except the community operator or service provider tacks on extra costs.

Venmo Debit Card

The Venmo Mastercard® debit card is non-compulsory. It has no annual charges and works at any service provider accepting Mastercard funds in america.

Sadly, you can not store with abroad retailers even for those who’re purchasing from throughout the U.S.

You’ll be able to earn money again at choose retailers by purchasing affords, and withdrawals at MoneyPass ATMs are no-fee. The Venmo Debit Card funds purchases out of your present Venmo steadiness however received’t pull out of your linked checking account or encounter overdraft charges.

Venmo Credit score Card

A no-fee Venmo Credit score Card is accessible. It affords money again on each buy, though it’s essential to pay your steadiness in full to keep away from curiosity costs.

Your incomes potential is as follows:

- 3% again in your prime spend class every month

- 2% again on the following highest spend class

- 1% again on all remaining purchases

What Is PayPal?

PayPal launched in 1998 and commenced facilitating digital transactions in 1999. At present, it’s a digital pockets that allows you to ship cash to associates domestically or abroad, obtain PayPal Money funds from freelance clients, or pay for on-line purchasing excursions.

PayPal has bought a number of monetary and retail companies, together with:

Like Venmo, PayPal affords debit and bank card merchandise which are non-compulsory and free to use for. You can too cut up purchases by its purchase now, pay later companies, though the charges could be costly.

Many individuals have a PayPal account because it’s entrenched within the on-line commerce sphere. In lots of instances, it’s nonetheless the one method to ship or obtain cash to a enterprise or particular person, though a number of PayPal options exist.

There’s a lot to love about PayPal, however some customers have complained that it’s more difficult to navigate than different digital wallets.

The right way to Be a part of PayPal

You should be not less than 18 years outdated and dwell in one of many 200+ supported nations. The platform permits you to create a private or enterprise account.

Begin the enrollment course of from the PayPal web site or obtain the app to your Android or iOS system.

You’ll want to offer your cell phone quantity, authorized title, dwelling handle, and e-mail. It’s potential to hyperlink a checking account and debit or bank card as soon as your account is lively.

How Does PayPal Work?

You’ll be able to ship or request cash from the cell app or on-line dashboard. There may be additionally an internet purchasing part to browse the newest cashback affords and earn rewards factors by PayPal Rewards.

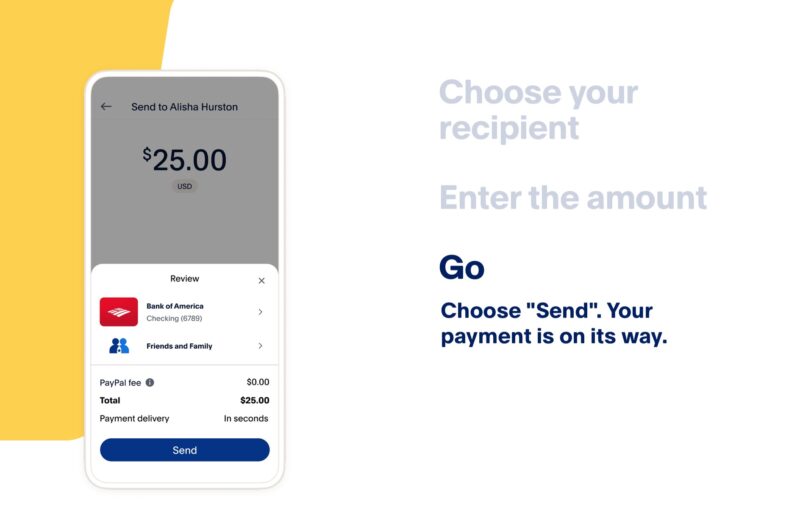

Sending Cash

You’ll be able to ship cash on PayPal to just about any nation worldwide by coming into the recipient’s title, PayPal username, e-mail, or telephone quantity.

Transfers between private accounts are free for each events when the sender chooses “Mates and Household” and makes use of their present PayPal steadiness or a linked banking account because the funding technique.

Charges apply for worldwide transfers or when funds come from a credit score or debit card.

You can too connect a private notice. Nonetheless, in contrast to Venmo, there isn’t a social feed to your community to see the exercise.

Receiving Cash

You’ll be able to request cash by initiating a Household and Mates switch to a different person. It’s additionally potential for freelancers and companies to ship an bill, though transaction charges happen.

It’s additionally potential to ship a PayPal.Me hyperlink to request fee.

Paying for Purchases

There are a number of methods to buy on-line and pay for in-store purchases. In the event you provoke purchasing periods by your PayPal account, you possibly can earn money again.

Many retailers even have a PayPal fee choice to make use of your current steadiness or a linked fee quantity to finish the transaction.

PayPal Charges

It’s potential to make use of PayPal with out paying any charges to make purchases or ship cash to associates. Usually, the charges are usually larger than Venmo whenever you’re promoting merchandise nevertheless it has extra promoting instruments and worldwide cash options.

Account Service Charges

- Account Setup: $0

- Month-to-month Service Charge: $0

Spending or Sending Cash

- On-line purchases: $0 (whatever the fee technique)

- Sending cash to associates along with your steadiness, checking account, or Amex Ship: 0%

- Sending cash to associates along with your bank card: 2.90% plus a hard and fast price

- Worldwide cash transfers: 5.00% (minimal $0.99) for all funding strategies

Including Cash to Your PayPal Account

These account funding sources received’t incur a price (excluding Items and Companies and enterprise/charity funds):

- Funds acquired in your private account from one other PayPal person

- Linked checking account

- Direct Deposit

- Service provider refunds

Cell verify deposits are topic to those costs:

- 0%: When ready ten days to your funds to develop into obtainable

- 1% (minimal $5 price): Prompt deposits for pre-printed payroll and authorities companies checks

- 5% (minimal $5 price): Prompt deposits for non-payroll and non-government checks

A flat price of two.99% applies to Items and Companies transactions in a private profile in comparison with 1.9% plus $0.10 by Venmo. You might encounter this price for those who’re promoting stuff on-line because the sale is eligible for purchaser and vendor safety advantages.

Withdrawing Funds from PayPal

Customary digital withdrawals to your linked checking account are free however require 1-3 days to finish.

Prompt transfers that clear inside minutes to your debit card or checking account price 1.75% (minimal price of $0.25 and a most price of $25).

The switch restrict is $25,000 per transaction to a linked checking account and $5,000 for fast withdrawals.

Foreign money conversion charges may also apply for worldwide withdrawals.

Cryptocurrency

A price applies every time you purchase or promote cryptocurrency inside your account:

| Buy or Sale Quantity | Charge |

| $1.00 to $4.99 | $0.49 |

| $5.00 to $24.99 | $0.99 |

| $25.00 to $74.99 | $1.99 |

| $75.00 to $200.00 | $2.49 |

| $200.01 to $1,000.00 | 1.80% |

| $1,000.01 or extra | 1.50% |

PayPal Mastercard Charges

The non-compulsory PayPal Debit Mastercard costs the next charges on money withdrawals:

- In-network ATMs (MoneyPass community): $0

- Non-network ATMs: $2.50

- Over-the-counter withdrawals (banks and monetary establishments): $3.00

- Overseas transaction price: 2.5%

There are not any charges to make purchases or verify your steadiness except the community operator or service provider tacks on extra costs.

A full record of PayPal charges is accessible right here.

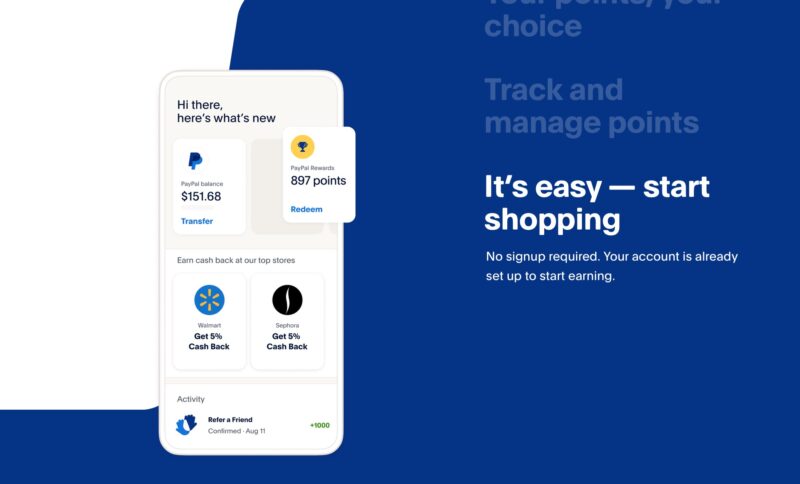

PayPal Rewards

The digital pockets has an in-house purchasing rewards program referred to as PayPal Rewards (beforehand PayPal Gold). You’ll be able to earn factors on qualifying purchases by the PayPal app, web site, or PayPal Honey browser extension.

It’s free to earn and redeem rewards. Your redemption choices embody purchasing credit on future PayPal purchases or money again.

PayPal Debit Card

The PayPal Debit MasterCard doesn’t have a month-to-month price and works worldwide, though international transaction charges apply. As well as, you can also make free ATM withdrawals at over 37,000 MoneyPass community ATMs.

This card additionally earns PayPal Rewards factors at taking part retailers to economize on future purchasing journeys.

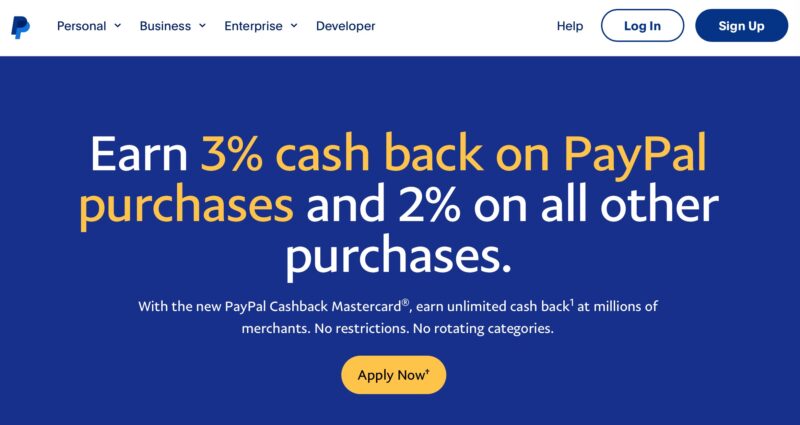

PayPal Credit score Card

PayPal’s Cashback Mastercard, which is issued by Synchrony Financial institution, doesn’t have an annual price. It earns 3% again on PayPal purchases and a pair of% on all remaining purchases.

You need to use the cardboard worldwide, however a 3% international transaction price applies for worldwide transactions.

Why Venmo is Higher Than PayPal

Think about using Venmo as a substitute of PayPal for these causes:

- Simpler-to-use platform

- Simply cut up purchases with associates

- Just like the social feed to share transactions with associates

- Decrease charges on Items and Companies transactions

As a reminder, Venmo solely works in america right now and can’t be used to ship cash or make purchases abroad.

Why PayPal is Higher Than Venmo

PayPal is superior for these causes:

- Can store or ship cash internationally

- Many on-line retailers settle for PayPal funds

- Extra enterprise instruments to obtain or ship funds

- Extra rewards purchasing affords

PayPal might have a barely harder-to-use platform, nevertheless it works nearly anyplace on the planet, making it the simplest method to ship or obtain cash. It may also be extra versatile for companies and particular person sellers regardless of the upper charges for Items and Service transactions.

Venmo vs. PayPal: Remaining Ideas

PayPal and Venmo get the job carried out if that you must ship or obtain cash. Each platforms are additionally appropriate for purchasing, though PayPal’s Checkout Button is extra acknowledged, they usually assist worldwide purchases.

Nonetheless, Venmo could be the higher choice for private accounts throughout the U.S., as you possibly can simply ship cash with out charges. When costs are incurred, the overall price is barely decrease than PayPal, and its purchase-splitting instruments and app are extra user-friendly and interactive.