In relation to sport altering developments in funds, the arrival of low-cost index funds must be up there.

Jack Bogle of Vanguard is essentially credited with being the creator of index investing and he’s on the Mount Rushmore of private finance, so far as I’m involved.

Index funds supply a really compelling gross sales pitch:

- Prompt funding within the inventory market (regardless of the fund represents)

- Exceptionally low charges (usually lower than 0.05%)

- Low upkeep

However are there dangers to index funds? Are there any the reason why we shouldn’t be utilizing index funds?

Right now, I wish to play somewhat Satan’s Advocate and level out a number of the potential dangers of index investing:

Desk of Contents

Index funds don’t substitute monetary planning

While you learn private finance recommendation, you’ll usually hear consultants say “put money into low value index funds.” Give attention to how a lot you’re saving after which make investments the excess in index funds.

Whereas technically right, it glosses over a key side of your funds – your monetary plan.

It’s vital that you just sit down and give you a monetary plan. You are able to do this with a fee-only monetary planner or begin one by yourself. The fundamental gist is that you determine your future monetary targets after which construct a financial savings and funding plan that will help you obtain it.

From there, it can save you and make investments in the direction of these long term targets utilizing investments comparable to index funds.

Excessive focus in know-how

When consultants discuss investing in index funds, they’re most frequently speaking in regards to the S&P 500 index. It’s a preferred one as a result of it presents a pleasant steadiness of danger and returns.

Nevertheless it doesn’t provide the whole inventory market (that will be a complete market index fund). There are dangers to concentrate on in any index however that is what it is advisable know in regards to the S&P 500.

The S&P 500 is a market cap weighted index, which suggests corporations with bigger market caps will make up a bigger share of the index. When you’ve gotten the likes of Microsoft, Apple, Google, and different tech giants value billions… you find yourself with an index that’s tech heavy.

How tech heavy? YCharts has an inventory of the SPY holdings and the primary 5 corporations are know-how – Apple, Microsoft, Amazon, NVIDIA, and Alphabet (Google). SPY is the SPDR S&P 500 ETF Belief.

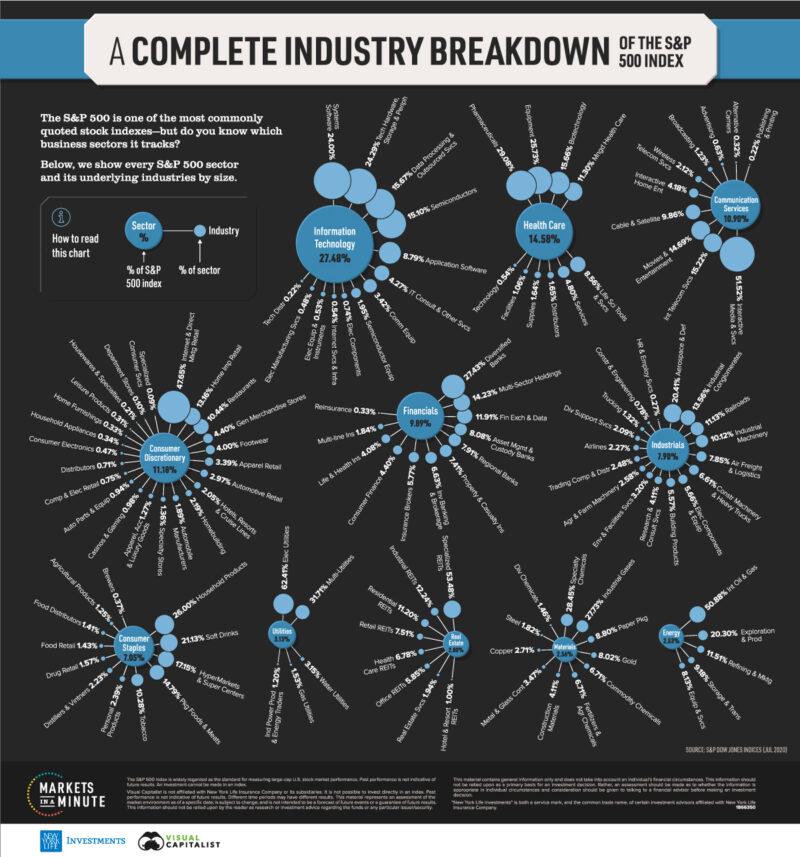

This graphical illustration of the S&P 500 Index from Visible Capitalist can provide you a way of how concentrated the index is in know-how (it’s from July 2020):

That chart is nearly three years outdated and we all know loads has modified throughout the market in that point however the basic tendencies are related.

A Monetary Occasions article from April twenty fifth, 2023 mentioned how the S&P 500’s efficiency this yr is essentially as a result of know-how corporations concerned in AI (giant language fashions). These “six LLM Innovation corporations MSFT, GOOGL, AMZN, META, NVDA, CRM clarify 53% of S&P 500 efficiency.” Additionally, Microsoft and Apple account for 13.4% of the S&P 500 index!

The chance with the S&P 500 is that you just’re getting a whole lot of discover to know-how. One may argue that whereas this can be a danger, because of the focus, it’s additionally a energy as a result of know-how performs fairly effectively.

You’ll be able to’t beat the market

By definition, you may’t beat the market with an index fund.

However you may’t underperform both.

🤣

You lose some management on taxes

Index funds lack some tax benefits you’ve gotten whenever you put money into particular person corporations. For instance, you’re unable to harvest tax losses from particular person corporations since you personal shares of a fund, relatively than of the underlying equities.

You’ll be able to nonetheless harvest losses of the fund itself however in case you are often contributing (and shopping for shares of the index fund), you’ll run afoul of wash sale guidelines in the event you aren’t cautious.

Additionally, you’re chargeable for the web good points from the funds. Typically they’re required to purchase and promote through the yr, comparable to with an index change, and people are taxable occasions that get handed onto you. While you management your personal investments, you may determine when to purchase and promote.

With index funds, the supervisor decides (or they’re pressured to, comparable to if lots of people take cash out of the fund) and you could end up with somewhat little bit of a tax shock on the finish of the yr. This can be a danger of all mutual funds although, not simply index funds, however index funds are much less seemingly to do that.

You might get lazy

The great thing about index investing is which you could set it and overlook it.

Besides you may’t utterly overlook it. A whole lot of your investing choices are taken care of however you continue to want to remain on prime of them.

You might want to rebalance on occasion (a few times a yr) to ensure your allocations match your goal. You additionally need to reassess your allocations each few years, to ensure they’re aligned together with your targets.

However it might turn into very simple to fall into the entice of “Okay, I’m invested, now I can go away it alone endlessly.”

This danger is straightforward to mitigate with reminders to examine in in your investments periodically. I carry out a cursory overview my investments every month (to observe our internet value) after which a more in-depth look every quarter to see if there are any changes we have to make.

Not all index funds are created equal

Vanguard and Constancy has proven us that low value index funds can be found to everybody. There’s only one drawback… not all index funds are low value.

The Rydex S&P 500 Fund Class H (RYSPX) is an index fund that seeks to trace the efficiency of the S&P 500 index.

OK nice… besides it prices an expense ratio of 1.56%!

Are you kidding me?

- Vanguard’s S&P 500 ETF (VOO) prices solely 0.03%.

- Constancy’s 500 Index Fund (FXAIX) prices 0.015%.

- Charles Schwab’s S&P 500 Index Fund (SWPPX) prices 0.02%.

Index funds are nice however don’t assume that as a result of it’s an index fund, it’s low value.

Double examine the prospectus. There are folks invested with Rydex and paying 100x greater than the oldsters at Constancy. FOR NO REASON.

Index funds may get TOO huge

This isn’t a danger for you personally however for the market as a complete – what occurs if index funds are too huge? This story within the Atlantic from 2021 took a glance into the concept that index funds may wield an excessive amount of energy. Again then, index funds management 20-30% of the American inventory market.

When corporations are added to an index, as was the case not too long ago with Tesla, it has a huge impact on the inventory worth. Does that imply index funds are over-valued just because they’re in an index? Does that imply fund managers are overpaying and returns will likely be muted sooner or later? It’s arduous to say.

Are index funds value it?

Sure. 100%.

Index funds are a improbable funding possibility however they don’t seem to be a panacea. While you decide your asset allocation, it’s important to consider carefully in regards to the position index funds will play in constructing your portfolio. Whilst you can accomplish loads with one thing easy, just like the three-fund portfolio, it nonetheless requires some care and a focus.

Additionally, as you age, your wants will change. You might be comfy utilizing a 120 minus your age allocation whenever you’re 25 or 30, however as you become old that simplicity might not be as engaging. You might accumulate extra wealth and never be comfy with all of it being available in the market. You might want to add different asset courses to the combo or different hedges based mostly in your wants and targets. An index might not be acceptable.

Index funds are a very good software within the monetary toolkit however they’re not the one one.