When you spend any time with FinTV – even when it’s muted within the background – you’ll have been handled to a debate as to “Are we in a brand new bull market?” or not. Typically it’s phrased as “Is the bear market over?”

I consider that is the incorrect means to consider bull and bear markets.

We’ve beforehand mentioned why the 20% bull/bear body of reference is just noisy nonsense.1 It’s a meaningless, media-creation fiction, a rule of thumb with no proof exhibiting it to be vital (past the actual fact we have now that many fingers and toes).

However there are a lot of different good causes to keep away from the “Purchase Now, No, Promote Now” debate: First, few are any good at selecting bottoms and tops; Second, nobody ought to run “actual” cash2 that means as the prices for being incorrect are just too nice. Third, it’s an method that usually lacks the form of course of important to good investing.

Good traders perceive that bear markets and volatility are a part of the place returns come from; these long-term traders have discovered that using them out is their highest likelihood method.3

You would possibly discover it helpful to as a substitute consider Bull/Bear discussions when it comes to context: When, The place, and for How Lengthy.

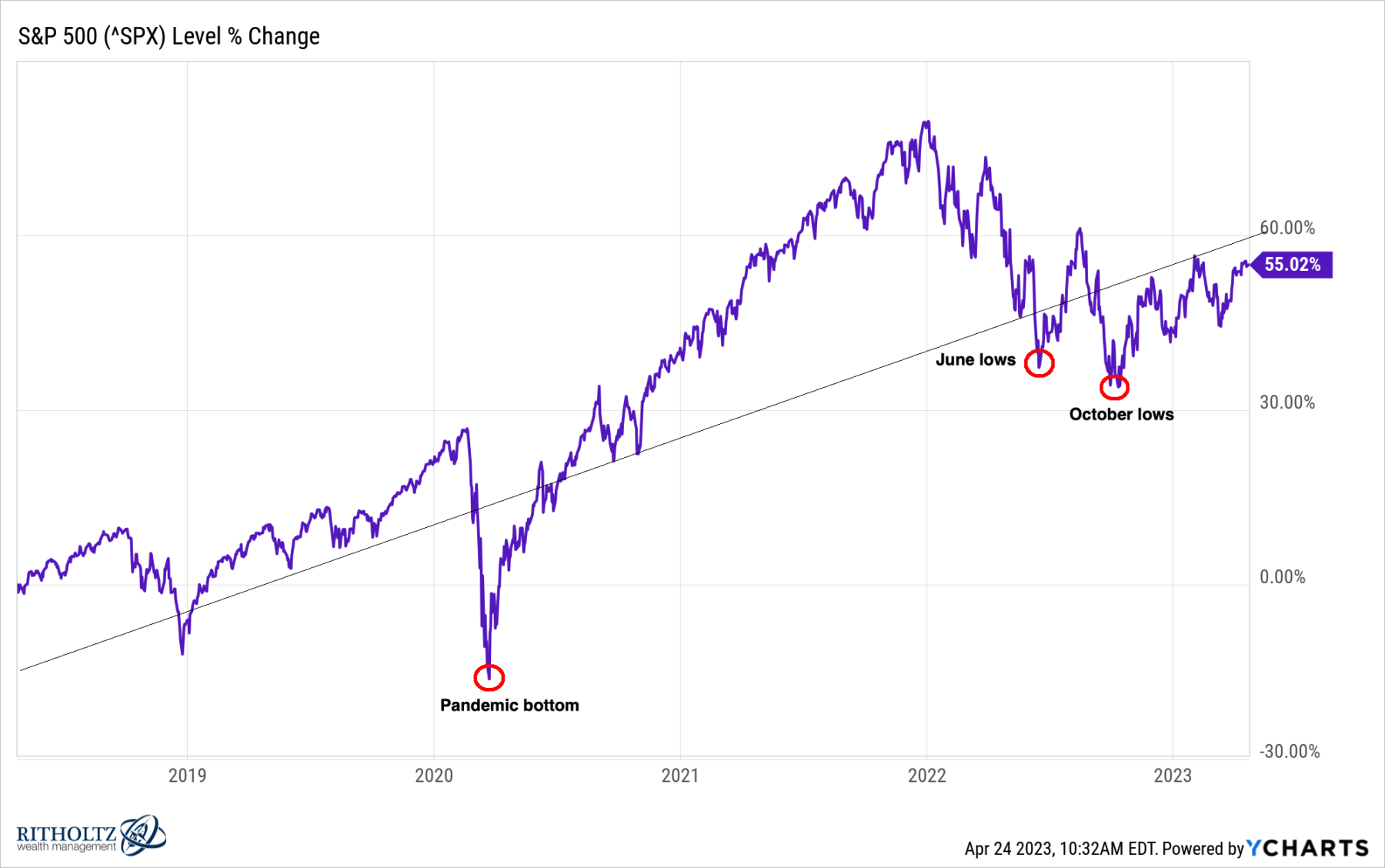

When: Framing the query of “when” is just asking what’s the bigger time frame round any explicit market transfer. Is that this a pullback happening inside the context of a bigger up transfer? Is that this a bounce within the midst of a relentless grind decrease? Understanding the broader context of when this transfer is happening is beneficial in understanding the chances of it persevering with.

Markets are like fractals, and what you see if typically dependent upon the timeframe you’re utilizing. It’s possible you’ll discover very completely different conclusions in case you deal with minutes, days, weeks, months, quarters, years, or a long time. A considerable chunk of market debates appears to be individuals with completely different time horizons speaking previous one another. The time intervals I discover helpful are secular market strikes that may final a long time and cyclical strikes that final months.

The place: On this morning’s reads, I referenced J.C. Paret’s dialogue of abroad beneficial properties. When individuals complain they’re in a bear market, we must always acknowledge that they’re typically exhibiting “residence nation bias.” Simply because their native bourse is in a drawdown doesn’t imply that the entire fairness markets on the earth are in additionally in a drawdown. As JC famous: “It’s not the bull market’s fault that your nation is underperforming.”

Certainly, diversification geographically typically implies that numerous fairness holdings are behaving in another way. Think about 4 geographic areas: The US, the Developed world Ex US, Rising markets, and Frontier. All of them have completely different sensitivities to financial components like commerce, inflation, commodities, and progress. Inside the fairness portion of your portfolios, they will present some measure of diversification.

How Lengthy: My favourite context for enthusiastic about markets is the longer-term secular bull and bear markets is the phrase “secular.”

A Secular Bull Market is an prolonged time period (10-20 years) pushed by broad financial shifts that create an atmosphere conducive to rising company income and earnings. Its most dominant function is the rising willingness of traders to pay an increasing number of for a greenback of earnings. Secular bear markets aren’t as lengthy lasting, are extra violent, however in any other case are the flipside of a bull.

However understanding once we are in a secular bull market would possibly permit you higher context to consider danger, and about the way to handle your individual conduct relative to turmoil.

One of many subtexts of the above is that for the overwhelming majority of traders, Martin Gabel‘s admonition of “Don’t simply do one thing, sit there” is most frequently their greatest method.

Markets are complicated mechanisms. Oversimplifying them into narratives or counting on context-free myths is not going to serve your portfolio nicely.

Beforehand:

Observations to Begin 2023 (January 3, 2023)

Bottoming? (December 1, 2022)

Secular vs. Cyclical Markets, 2022 (Might 16, 2022)

Bull Market Bull (March 31, 2021)

Redefining Bull and Bear Markets (August 14, 2017)

Are We in A Secular Bull Market? (November 4, 2016)

__________

1. If you wish to learn extra on why 20% shouldn’t be vital, see this, this, this, and this.

2. Actual when it comes to each significance to traders and measurement. No person needs to be swinging round billions of {dollars} primarily based on intestine intuition, and definitely not retirement accounts or different essential capital.

3. Word we have now not even referencing the valuation debate.

The publish When, The place, and for How Lengthy… appeared first on The Huge Image.