Elevate your hand when you’ve an issue with determining which card is greatest to swipe for every transaction for optimum rewards. With Max MRS, now you can manually lookup the MCC earlier than you pay. Nonetheless appears like an excessive amount of work? Then dangle on tight for Max Card, an AI device that guarantees to routinely search and route it to one of the best card in your behalf.

Most of us are likely to have a number of bank cards, particularly since completely different playing cards supply various ranges of rewards on several types of spend.

However how are you aware which card to make use of for which transaction?

To resolve that query, you’d must know:

- The service provider class code (MCC)

- Minimal spend and/or class limits

- Ongoing promotions and bank card presents

- Adjustments in T&Cs

- Exclusion classes

Most individuals find yourself NOT incomes their full bank card rewards

As you possibly can see, there’s lots to recollect and pay attention to with regards to getting probably the most rewards out of 1’s bank cards. It may be a extremely tedious endeavour, so most individuals both resort to (i) tough guesstimates or (ii) quit and stick to at least one all-in card.

The issue with guesswork is that you just inevitably lose out on varied rewards, particularly if you guess incorrect or fail to maintain up with T&C adjustments in your bank card e.g. you can beforehand earn miles / cashback utilizing AMEX playing cards for Seize top-ups, however that has since been nerfed earlier this 12 months.

And whereas utilizing a single card is actually handy, the trade-off is that you just accept a awful reward earn fee too (e.g. 1+ mpd as a substitute of 4mpd). Which is a bit foolish when you can optimize (albeit with some effort) to get greater than double your miles, successfully shortening the time and quantity that you must spend earlier than you qualify on your desired flight(s)!

What’s the Service provider Class Code (MCC)?

Bank card issuers typically award you with reward factors, miles, or cashback based mostly on the MCC of the service provider the place a purchase order is made. These MCCs are assigned by fee card organisations (e.g. Visa, MasterCard, American Specific). Notice: MCC codes should not at all times constant both; it’s doable for a service provider to be coded in a different way on Visa vs. MasterCard.

So as to add to the confusion, a service provider’s registered MCC might not at all times correspond with its nature of enterprise! Listed below are some examples I’ve encountered:

- Tempted to make use of your greatest eating card on your invoice at Prego (situated in Fairmont Lodge)? Not so quick – Prego falls below MCC 3590 (Inns), which is a subset below Journey.

- Utilizing your 4mpd for on-line purchases on iShopChangi? Sorry, however that falls below MCC 4582 (Airports) even when you’d made your fee on-line.

- You’ll be able to’t use your greatest on-line card to pay on your Fb adverts, as a result of that’s categorized below MCC 7311 (Promoting companies), that are sometimes excluded by most playing cards for bonus rewards.

Whereas there’s a listing of MCCs, there isn’t a checklist that matches them to the companies in Singapore. Beforehand, we may search on WhatCard or use the notorious HWZ bank card spreadsheet, however even the founders behind each have since given up, which suggests the cardboard rewards tracked there are actually outdated and there’s no solution to verify for newer retailers similar to Spago and even TikTok Outlets.

However the excellent news is, we now have one other workaround.

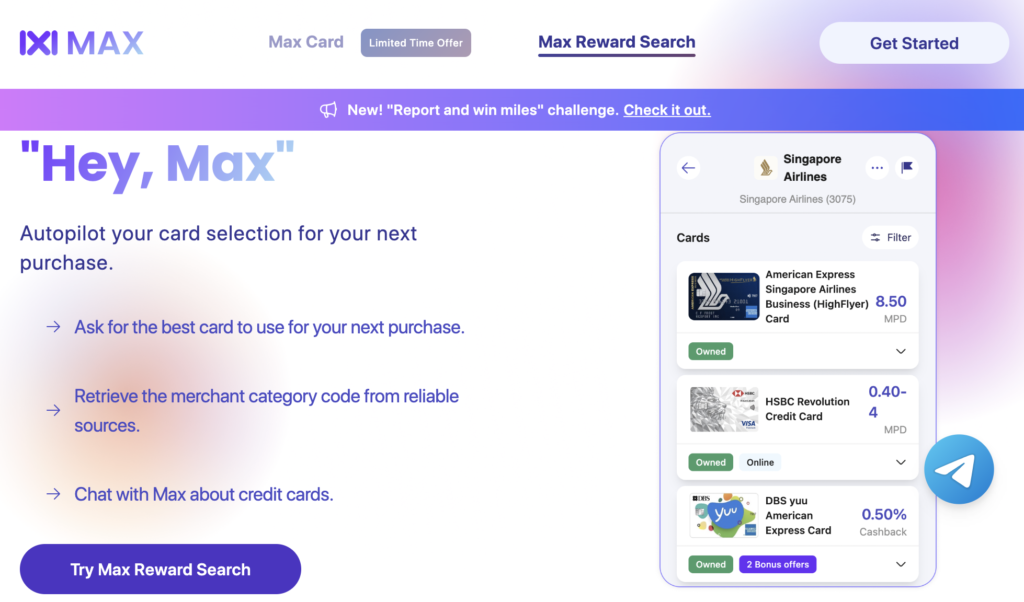

Introducing: Max Reward Search

In any other case often known as Max MRS.

Max MRS is a brand new MCC-lookup device, which lets you lookup a service provider’s MCC earlier than swiping your card, so you possibly can maximise your miles or cashback on each transaction you make.

For these of you who wish to make certain earlier than you transact and never threat shedding out on any rewards, you’ll love this.

The MRS dataset leverages identified Visa, MasterCard and AMEX MCC codes in addition to crowdsourced suggestions.

This jogs my memory of the now-defunct WhatCard and HWZ spreadsheet, besides that the group continues to be actively populating knowledge, and there’s extra retailers being coated – not simply in Singapore, however abroad as properly.

You’ll be able to already use this device – merely join an account right here!

At any fee, that is far simpler than the opposite (nonetheless out there) methodology through the DBS digibot, which requires you to:

- briefly block your card,

- try and cost your transaction anyway,

- then verify with the DBS digibot (below the Declined Transaction class),

- retrieve the service provider description from the failed transaction particulars

- match it to Citi’s MCC checklist right here.

My pal Aaron over on the MileLion has a useful article describing the precise technique of how this works. For these of you who don’t thoughts the trouble (and potential embarrassment in entrance of the cashier) concerned on this methodology, try the article right here.

Whereas Max MRS is already a welcome device right this moment, what’s extra thrilling is that the corporate behind it goals to launch Max Card later this 12 months.

Max Card: Use one of the best card every time

Come This fall 2023, it’s possible you’ll not even must manually seek the advice of Max MRS to search out out MCC codes anymore. As an alternative, Max Card will routinely route your transaction to one of the best bank card that earns you the best rewards.

This implies you received’t even want to hold round a number of playing cards in your pockets anymore – the Max Card is the one one you’ll want!

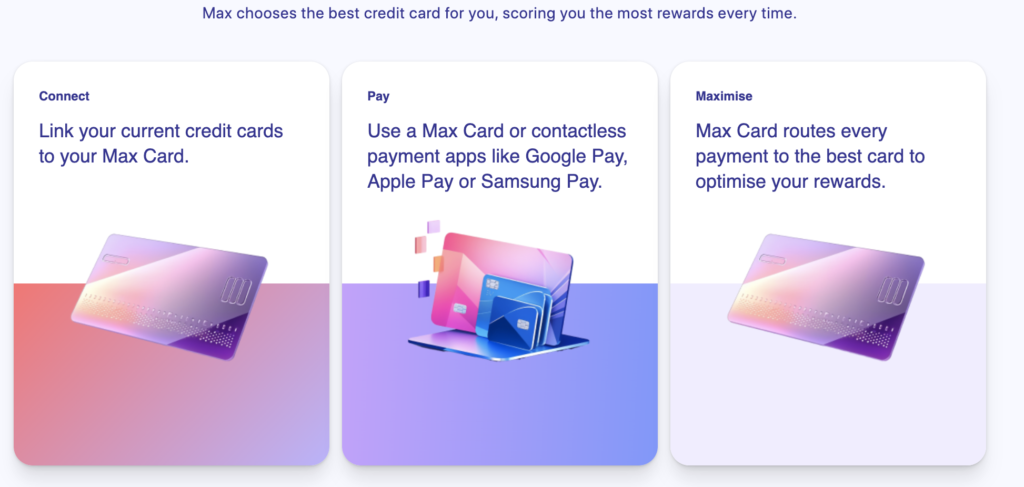

I requested the group how that’s even doable, and right here’s their clarification:

- You enter the service provider, which is then checked for its MCC

- The MCC is then run by the Max MRS engine to evaluate what reward it might earn for every bank card, and presents that to the consumer

- Extra knowledge – similar to restricted time offers by the banks / service provider / different apps – may also be offered if out there

In different phrases, Max Card appears like the reply to the perennial query of, “what bank card ought to we use for this transaction?”

If the group is profitable, Max Card may actually simplify the complicated bank card area by eliminating the necessity for us customers to memorize phrases and circumstances, hold monitor of min/max spend necessities, altering promotions and bonus charges, annual price waivers, and extra.

Other than MCC codes, Max additionally supposedly tracks:

- Newest bank card presents

- T&C updates

- Bank card waivers

Because of this theoretically, you can use the Max Card to earn 6 mpd in your UOB Girl for eating and auto change again to HSBC Revo as soon as that’s up. And in case your HSBC Revo $1,000 cap has been met? Properly, Max ought to then route it to your subsequent greatest card for eating.

Since Max is already geared up with data of the assorted MCC codes on the again finish, this proposition really sounds possible.

Properly, what occurs when you discover out Max has routed a selected transaction to the incorrect card?

There’s apparently a Max Time Machine function, which can allow you to change playing cards even after you paid.

I believed this sounded a bit dodgy, till I questioned the group and so they informed me that the function already exists over within the UK:

After all, even when the expertise is perfected, there’s certain to nonetheless be edge circumstances the place I can think about Max getting it incorrect. The group has mentioned that to handle this situation, they run a Telegram group chat right here the place you possibly can present suggestions and report such edge circumstances for them to appropriate.

Let Max Card hold monitor of every thing for you. Greatest rewards, T&C updates, transactions, loyalty programmes. It may well even deal with your bank card price waivers!

Sponsored Message

My ideas on the Max Card

A few of you guys may do not forget that as soon as upon a time (pre-kids), I constructed a bank card app with a fellow reader that was meant to unravel this perennial drawback. After all, it being a 2-man present, the app died a pure dying a number of years later when each of us may now not afford the sources wanted to repairs the app.

So whereas listening to concerning the Max MRS was thrilling, however the Max Card sounds even higher, and I sincerely hope the group is profitable.

My largest considerations are

- whether or not the group will have the ability to efficiently ship the product,

- after which make it commercially viable (as a result of everyone knows there’s solely a lot a group can do for “free”, even when within the public curiosity)

- and at last, how they intend to cease the banks and bank card issuers from blocking it.

In any case, giving out cashback / miles / reward factors is an actual price for the banks, so I wager they received’t be completely happy.

Conclusion

In the event you’re struggling over the query of “what MCC?”, use the Max MRS device to get your solutions.

In order for you extra assist together with your a number of bank cards so that you by no means need to DIY your personal rewards optimization course of, then keep tuned for the Max Card.

Though Max Card continues to be not out there (but), you possibly can assist make that occur by signing up for the waitlist right here.

The primary 1,000 sign-ups on the waitlist will get a ten,000 Max Miles bonus when the cardboard launches.

In case you’re late, you possibly can nonetheless earn a 2,000 Max Miles bonus by being among the many first 10,000 sign-ups.

Enroll right here right this moment and assist make the Max Card turn out to be a actuality!

Sponsored Message

Disclosure: This text is dropped at you in partnership with Max Inc. as I discovered the expertise too unbelievable to cowl it alone as an natural put up (that doesn’t get run by any factual checks by group or product creators itself). On my finish, as somebody with a number of playing cards myself, I really wish to see this resolution turn out to be a actuality (who wouldn’t?!), so let’s assist out and waitlist in order that the group could make this occur sooner slightly than later!