Because the U.S. inventory market has, on common, outperformed worldwide equities during the last 15 years since rising from the Nice Recession of 2008, many buyers argue that worldwide diversification is a poor allocation of {dollars} that may in any other case be incomes extra within the U.S. market. The outperformance of U.S. shares has led to the favoritism of ‘native’ investments over worldwide ones via behavioral biases (e.g., recency bias and the tendency to confuse the acquainted with the protected) which have swayed buyers (and a few advisors) away from worldwide diversification solely. Nevertheless, regardless of current market developments, there’s a official case to be made for worldwide diversification – beginning with the essential tenet of investing that previous efficiency doesn’t promise future returns.

On this visitor put up, Larry Swedroe, head of monetary and financial analysis at Buckingham Strategic Wealth, discusses why many buyers are inclined to fall prey to recency bias, and explains why international diversification – and maintaining short- and long-term leads to the proper perspective – stays a prudent technique.

One frequent argument made by buyers who chorus from international diversification is that, throughout systemic monetary crises, every little thing does poorly, main them to query the safety that worldwide diversification presents throughout massive market declines. Whereas analysis could assist this argument – that worst-case actual returns for particular person nations do are inclined to correspond with extreme declines throughout all nations globally – the development usually holds true just for the brief time period and the similarities in market habits for nations across the globe are inclined to deteriorate over the long-term, as completely different nations naturally get well at completely different charges. However as a result of nobody could be positive of when and the place these recoveries will occur, buyers who’re keen to unfold the chance of barely decrease returns from globally diversified portfolios stand to yield the rewards of getting an edge within the pure cycle of worldwide markets within the combination.

Opposite to the view that international diversification could provide little safety from market declines, it’s particularly salient in circumstances of a worldwide recession – whereas the typical particular person nation’s returns after such an occasion have a tendency to remain depressed, international portfolios go on to ultimately get well. In different phrases, whereas international diversification could not essentially present safety from the preliminary crash, it does create the potential for a considerably quicker restoration. And this habits tends to be extra pronounced with longer time horizons – that are in the end extra related for buyers with long-term wealth targets.

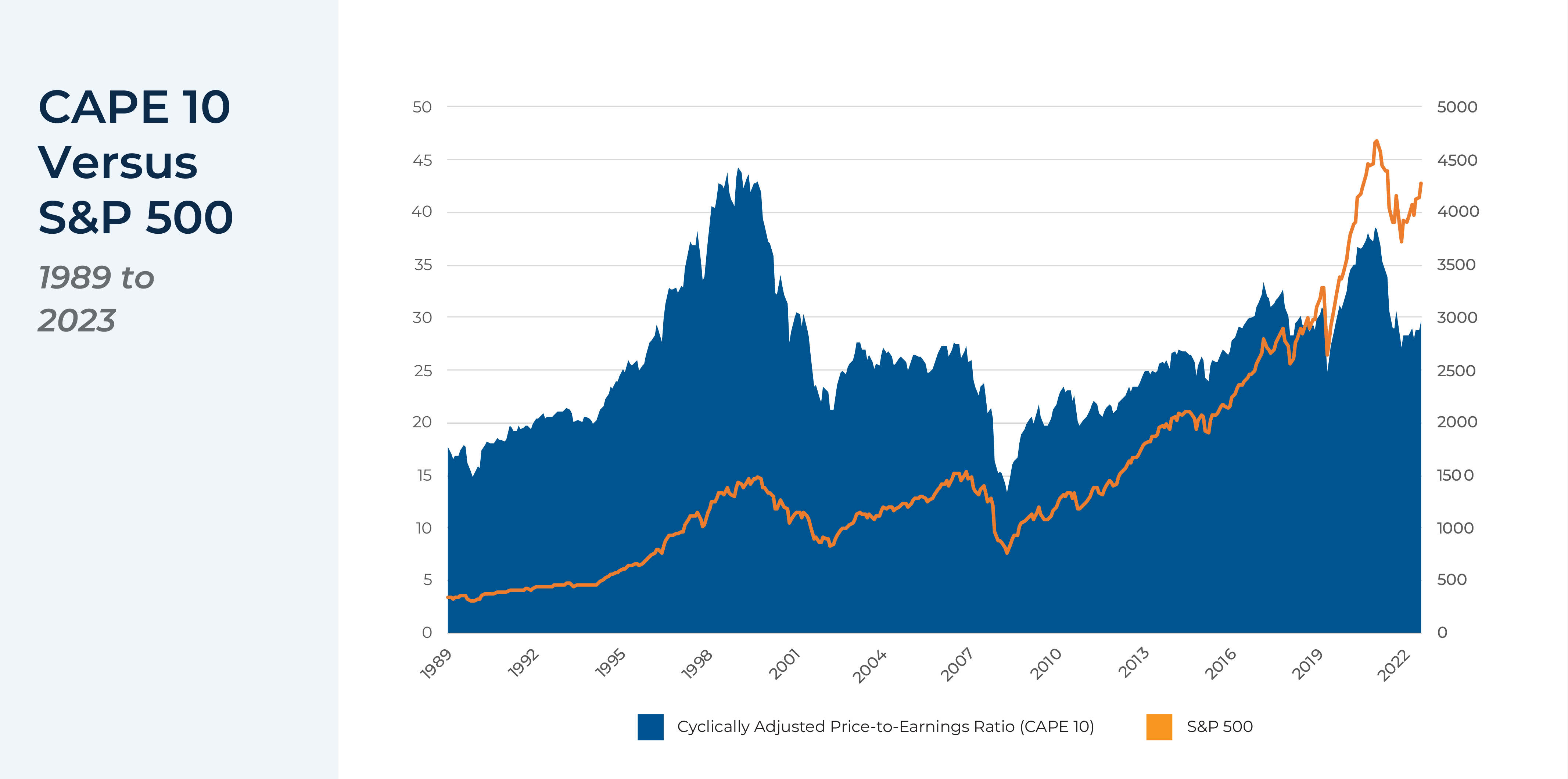

Along with overlooking international long-term restoration patterns, buyers usually fail to contemplate the essential position that valuation modifications play in funding returns. Regardless of the caveat that “previous efficiency is not any assure of future outcomes”, the patterns of historic previous earnings knowledge can provide perception into how an organization is valued, which might affect the efficiency of its shareholders’ fairness. For instance, a powerful case has been made for the predictive worth of the CAPE 10, a price-to-earnings metric designed to evaluate relative market valuation, which is very insightful in the case of long-term returns. As whereas funding returns could be pushed by underlying financial efficiency, similar to via development in earnings, they will also be pushed by modifications in valuations. And regardless that timing markets based mostly on valuations within the short-term has not confirmed to be a profitable technique, the CAPE 10 has been positioned as a helpful predictor of long-term future returns. Given the present (as of March 2023) financial positions for the U.S. CAPE (at 3.4%) and the EAFE CAPE 10 (5.6%), until these values change, buyers can moderately estimate EAFE markets to outperform the S&P 500 by 2.2% yearly.

Finally, the important thing level is that when evaluating for diversification, many buyers could be susceptible to behavioral biases that preclude them from sustaining a well-diversified risk-appropriate portfolio that depends on a mixture of U.S. and international investments. However by serving to shoppers develop a transparent understanding of the particular dangers of diversification and a wholesome perspective of historic market efficiency, advisors can put together their shoppers to remain disciplined and centered on long-term outcomes, ending out as each extra knowledgeable and extra insulated towards inevitable market dips!