Now that most cancers remedy prices will now not be coated 100% in Singapore, the significance of getting a supplementary rider on your hospitalisation plan is extra essential than ever earlier than. However which one do you have to get?

In the event you don’t already know, an enormous change for ALL Built-in Protect plans (IP) in Singapore has simply taken impact from 1 April 2023 onwards. Sufferers will now not have the ability to declare for the total prices of their most cancers remedy protection “as charged”, and claims will now be restricted to the medicine on the Ministry of Well being’s Most cancers Drug Listing (CDL) (view it right here) – as much as a most of 5 occasions the protection of the essential MediShield Life.

Being handled for most cancers is already a traumatic affair. Now, that’s going to worsen, as it’s important to begin worrying about having sufficient money to pay till you full your most cancers remedies.

And may your physician assess the perfect remedy on your situation to be non-CDL medicine or possibly even a mix of CDL and non-CDL medicine, then you might really feel the monetary pressure as non-CDL medicine will not be coated beneath your IP anymore. Even whether it is beneath the CDL, you should still have to pay money if remedy price exceeds MediShield Life’s protection limits.

What should you nonetheless need to have the ability to declare out of your insurer for outpatient most cancers remedy prices on non-CDL medicine?

Effectively, solely your supplementary riders will cowl you from right here, and your alternative of insurer for the non-public IP plan and its supplementary rider will decide how a lot you possibly can declare.

How will MOH’s Most cancers Drug Listing have an effect on us?

With this transformation, you possibly can now not assume that so long as you search remedy for most cancers in a public or restructured hospital, your insurance coverage will cowl it. As an alternative, you’ll now have to examine whether or not the remedy your physician prescribes is beneath the Most cancers Drug Listing. Even whether it is beneath the Most cancers Drug Listing, you should still have to pay money if remedy price exceeds MediShield Life’s protection limits.

However will we get to manage what most cancers medicine are appropriate for our situation, and even get to ask our physician to suggest solely medicine from the Most cancers Drug Listing?

The fact is, nobody is aware of till you get identified. It’s estimated that 10% of sufferers handled within the public sector won’t have their present remedy coated by medicine within the Most cancers Drug Listing, with the next share for these being handled in non-public hospitals.

With the latest change, even sufferers on Built-in Protect Plans (IPs) will solely be coated as much as 5 occasions of the prevailing MediShield Life drug restrict+ i.e. at present $200 – $9,600 a month. With immediately’s excessive medical prices for most cancers remedy, this implies ought to your remedy prices exceed this quantity, you’ll have to be ready to fork out the next money portion.

Be aware: Most cancers remedy is often 2 – 6 weeks per cycle, and relying on the kind and severity of your situation, you might want greater than only one cycle to kill off the cancerous cells.

+ MediShield Life Restrict depends on most cancers drug remedy because it ranges from S$200 to S$9,600. Check with the Most cancers Drug Listing (CDL) on the Ministry of Well being’s web site for the most recent MediShield Life limits.

- Swap to a remedy on the Most cancers Drug Listing

- Get protection via supplementary riders or standalone important sickness plans

- Apply for subsidised care and help from MediFund by way of a medical social employee

Because it stands, greater than 70% of individuals right here don’t at present have supplementary IP riders.

So should you’re among the many 70%, you would possibly need to assume critically about including a rider to your hospitalisation protection to deal with any gaps whilst you nonetheless can.

How will a supplementary IP rider assist?

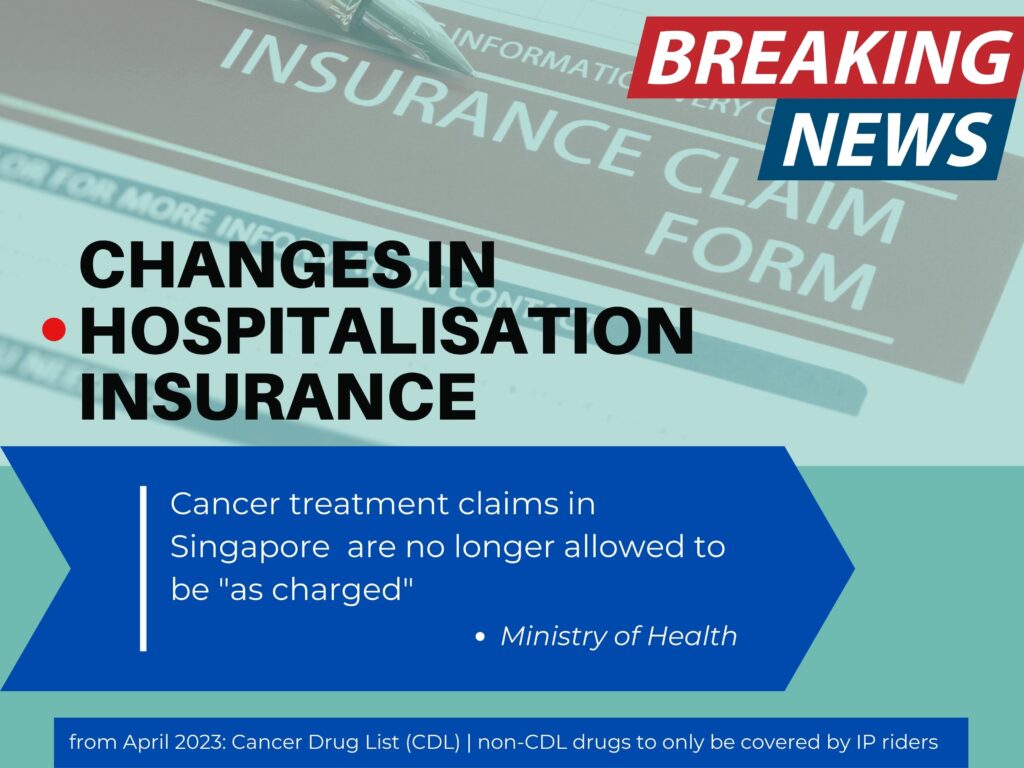

To know how riders will help, you first want to grasp how the totally different protection for hospital payments work right here in Singapore. The beneath exhibits how the Built-in Protect Plan and supplementary rider from Nice Japanese can complement your MediShield Life protection:

With every added layer of protection, you cut back your out-of-pocket bills. So should you’re involved about not having sufficient money to pay on your hospitalisation or most cancers remedies, then having a supplementary rider can considerably cut back your out-of-pocket cost and stop you from operating right into a situation the place it’s important to wipe out your complete emergency funds, or worse, resort to borrowing cash simply to get handled.

However earlier than you rush into getting a supplementary IP rider, you must also be aware that premiums for it should be paid for in money.

Since we can’t use our MediSave account to pay for it, we’ve got to plan for and make it possible for the supplementary riders match our finances (after all, ought to your monetary circumstances change, it’s also possible to contact your insurer to grasp your totally different choices obtainable, corresponding to downgrading your protection).

With no supplementary rider, sufferers might want to pay the deductible (which is cumulative over the yr you probably have a number of hospital visits) and 10% of the remainder of your payments. However with a supplementary rider, you’ll solely pay 5% of your payments, so long as medical remedies/consultations are being sought via one of many panel specialists.

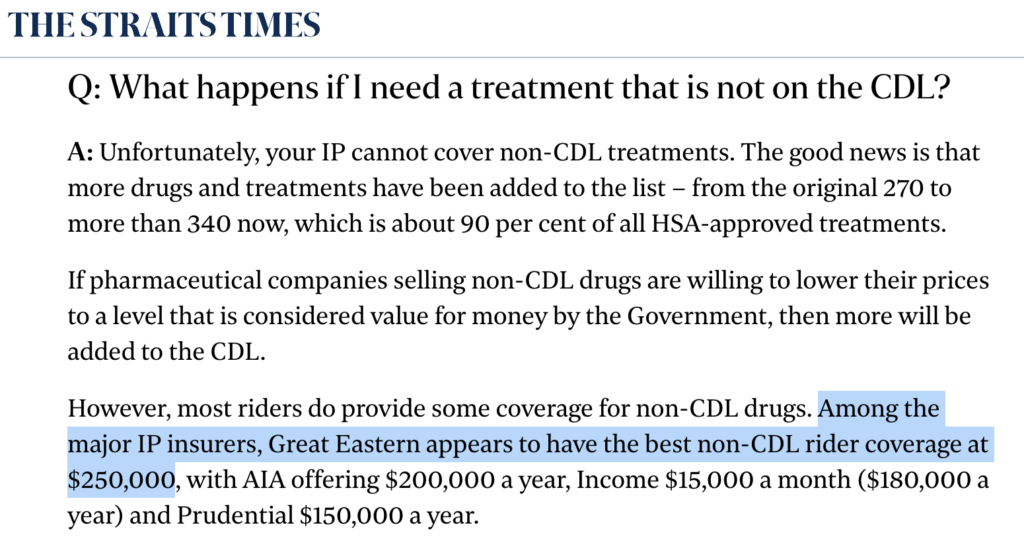

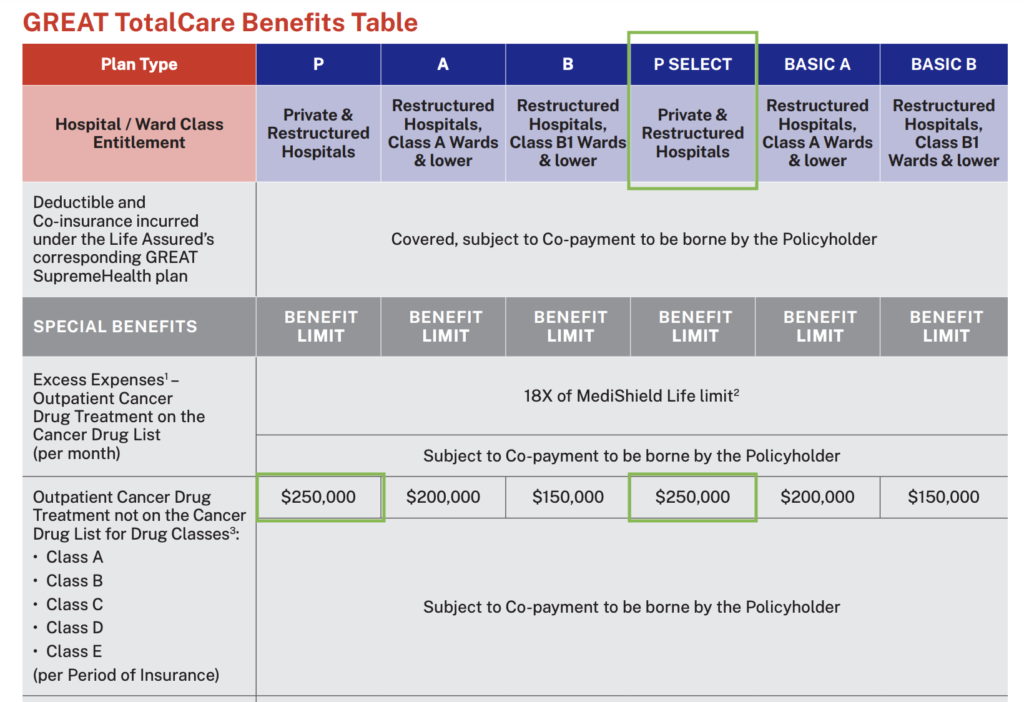

And amongst all of the IP insurers in Singapore proper now, Nice Japanese has the best non-CDL rider protection at S$250,000 – yearly.

The most effective half? Nice Japanese’s premiums are additionally amongst one of the inexpensive.

So should you requested me, going for an Built-in Protect plan like GREAT SupremeHealth and bundling it with a supplementary plan like GREAT TotalCare will likely be typically enough for many of us as we will be coated for as much as 95% of our complete hospitalisation invoice.

As for the portion that you simply’ll have to pay? Most of it would now be capped at S$3,000*.

*This money outlay of S$3,000 per coverage yr solely applies with GREAT TotalCare supplied bills had been incurred beneath panel suppliers or at restructured hospitals. As a great observe, I like to recommend all the time checking together with your insurer if the physician or hospital you’re getting handled at is on their panel so that you simply keep away from any invoice shocks in a while.

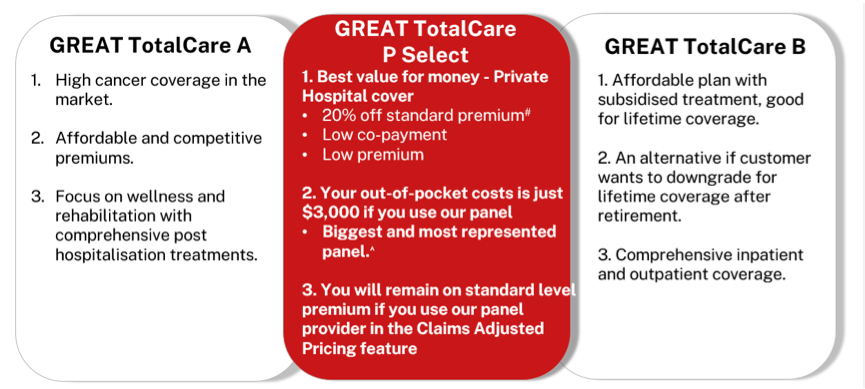

In line with Nice Japanese, their GREAT TotalCare P Choose has one of many most complete checklist of advantages at an inexpensive premium, probably making it one of many most value-for-money hospitalisation plans providing protection throughout each non-public and restructured hospitals.

Sponsored Message

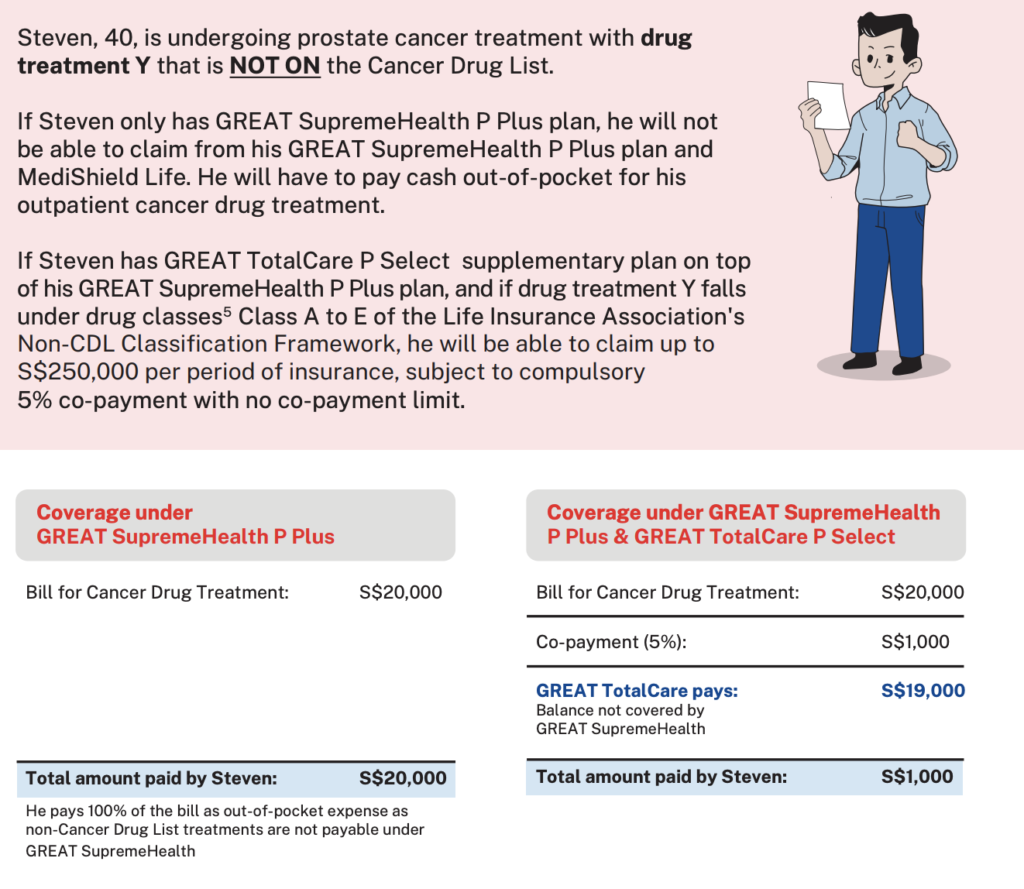

Right here’s how a claims illustration on Nice Japanese’s IP and supplementary riders for a non-CDL most cancers drug remedy will now seem like:

| MediShield Declare Restrict | GREAT SupremeHealth | GREAT TotalCare P Choose | GREAT TotalCare P | |

| Most cancers drug remedy (non-CDL) (yearly restrict) | Not coated | Not coated | $250,000 | $250,000 |

| Most cancers drug companies (yearly restrict) | $3,600 | $18,000 (5 x MSHL) |

As charged, topic to five% co-payment^ | As charged, topic to five% co-payment |

5 The Non-Most cancers Drug Listing Classification Framework offers better readability and facilitates a typical understanding of non‐CDL remedies coated by supplementary plan. Underneath the framework, most cancers drug remedies are grouped in keeping with regulatory approvals and scientific tips

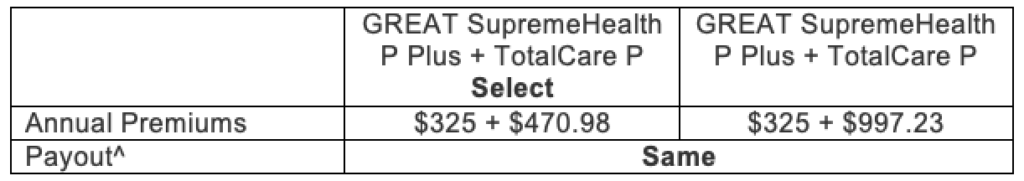

Since premiums rise with age, let’s have a look at how a lot the premiums vs payouts for “Steven” (age 40, non-smoker) would have been within the above situation:

^ Curiously, even when Steven had gone for the higher-tier rider (TotalCare P), he would nonetheless have obtained the identical protection as if he had been beneath the TotalCare P Choose rider as a substitute – regardless of paying lesser premiums.

Thus, for these of you who’re extra budget-conscious, it appears fairly obvious that TotalCare P Choose is a extra value-for-money possibility.

– you’re wholesome on the time of utility.

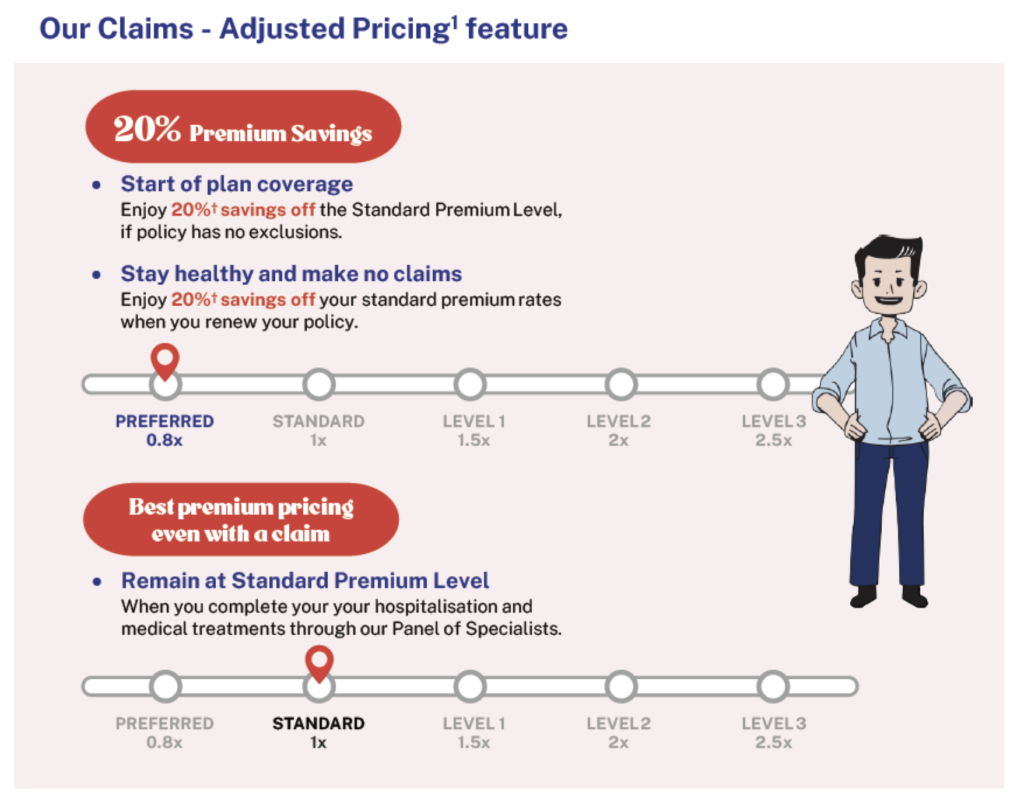

– In the event you don’t have any claims throughout your protection interval, the 20% off the Normal Premium Stage for every coverage renewal yr applies too.

^ Co-payment cap is topic to exceptions

Contemplating GREAT TotalCare P Choose?

As somebody who’s nonetheless in good well being and aiming to safe a complete protection with out breaking the financial institution, should you requested me, GREAT TotalCare P Choose definitely ticks each that standards.

Compared with different insurers, at ~$300 – $450 for these aged 20 – 39, the premiums are nearly half of what it’ll price for different related supplementary riders with non-public healthcare protection, however provides related privileges in relation to what issues to me.

2 The profit restrict for outpatient most cancers drug remedy varies in accordance with the MediShield Life restrict per thirty days (pursuant to the Most cancers Drug Listing discovered on the Ministry of Well being’s web site (go.gov.sg/moh-cancerdruglist)). The Ministry of Well being might replace this once in a while. For the needs of assessing the MediShield Life restrict, “per thirty days” shall imply the actual calendar month through which the outpatient most cancers drug remedy was administered and/or obtained.

3 Check with the “Non-CDL Classification Framework” by Life Insurance coverage Affiliation for the classification of most cancers drug remedies that aren’t on the Most cancers Drug Listing (https://www.lia.org.sg/media/3553/non-cdl-classification-framework.pdf). The Life Insurance coverage Affiliation might replace this once in a while.

Not solely are its premiums one of the inexpensive available in the market, it additionally provides complete protection that may assist ease your monetary worries in occasions of hospitalisation.

What’s extra, you possibly can get 20% off the Normal Premium Stage so long as you’re wholesome on the time of utility. And if you don’t make any claims throughout your protection interval, you’ll proceed to benefit from the 20% off (the Normal Premium Stage) every coverage renewal yr.

And for these of us who do intend to hunt remedy at public or non-public panel specialists, then GREAT TotalCare P Choose does seem like extra value-for-money as a substitute.

As a Nice Japanese SupremeHealth policyholder, do you know that you simply additionally get entry to Well being Join?

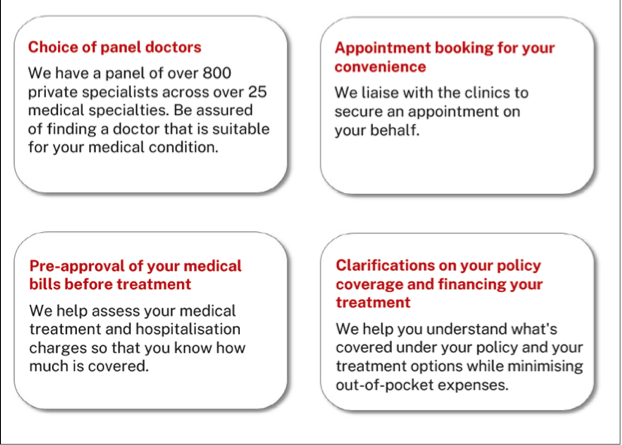

With one of many largest panels of over 800 non-public medical specialists throughout 25 specialities in Singapore, you possibly can select your most popular medical specialist and get handled with full certainty on what your coverage covers. That method, you possibly can keep away from any invoice shocks and deal with recuperating as a substitute.

Name Well being Join at 6563 2233 that can assist you with:

What’s extra, don’t neglect that going via Well being Join additionally will get you suggestions on probably the most appropriate medical remedy choices in order that your premium price on your subsequent yr’s coverage renewal will stay at normal premium degree. This fashion, you will get high quality healthcare together with your most popular panel specialist, whether or not in a restructured or non-public hospital, and nonetheless forestall your premiums from growing by 1.5 – 2.5 occasions resulting from a declare.

Conclusion: Get a supplementary rider should you can afford it

With the most recent adjustments, having a supplementary rider is now changing into a non-negotiable for these of us who don’t want to bear the burden of big out-of-pocket hospitalisation payments.

And as a part of my monetary planning, the very last thing I’d need is to have my complete emergency funds and life financial savings worn out by an surprising situation or hospitalisation.

For this reason I proceed to maintain my Built-in Protect Plan and rider (supplementary plan) to keep away from such a situation, however as a result of I have to ration my finances to pay for different kinds of insurance coverage as nicely, I select to forgo the best degree of riders, abroad protection and day by day hospital allowance. These are good to have, however finally not one thing that I really want.

In the event you too, are involved concerning the monetary affect that the most recent Most cancers Drug Listing might need on you, please converse with a monetary consultant to grasp the totally different choices obtainable that you would be able to have a look at, in addition to what they’ll price you.

And should you’re in search of Built-in Protect plans and/or riders that present complete protection, whereas rewarding you for more healthy dwelling, you might need to try Nice Japanese’s plans right here.

Disclosure: This publish is a sponsored collaboration with the Nice Japanese Life Assurance Firm ("Nice Japanese"). All opinions are that of my very own, and data correct as of June 2023.

Disclaimers: All premium charges are inclusive of 8% GST. Premium charges will not be assured and could also be adjusted based mostly on future expertise. All ages specified discuss with age subsequent birthday. GREAT TotalCare isn't a MediSave-approved Built-in Protect plan and premiums will not be payable utilizing MediSave. GREAT TotalCare is designed to enrich the advantages provided beneath GREAT SupremeHealth. This commercial has not been reviewed by the Financial Authority of Singapore. The knowledge introduced is for basic data solely and doesn't have regard to the particular funding targets, monetary state of affairs or specific wants of any specific individual. Protected as much as specified limits by SDIC. Data appropriate as at 21 June 2023.