There are few specialists on social media who’re displaying the yield to maturity of sovereign gold bonds and luring you to spend money on current outdated collection of SGB. Making use of YTM to sovereign gold bonds is misguiding.

Discuss with our newest posts on Sovereign Gold Bonds –

Yield To Maturity of Sovereign Gold Bond – Misguiding Idea!!

Whether or not we now have to use yield to maturity for sovereign gold bonds? The straightforward reply is NO. Simply because the title BOND is related to the product doesn’t imply that sure bond calculations could be utilized right here.

While you spend money on a bond, then you definitely pay the worth for it whereas shopping for. Throughout the preliminary subscription interval, it could be on the face worth and after that, it could be on the buying and selling worth. Throughout the holding interval of the bond (based mostly on the function of the bond), you might obtain the curiosity at a sure interval. At maturity, you’ll get again the face worth (not the worth at which you bought in a secondary market).

Let me provide you with an instance. Assume that the ten years authorities of India bond whose face worth is at Rs.1,000, coupon fee (annual curiosity fee) is 8%, and at present buying and selling at Rs.900. Then YTM or yield to maturity means should you purchase the bond on the present worth of Rs.900 and holding for as much as maturity, then it’s nothing however the return on funding. It means you’ll obtain an 8% annual coupon and in addition at maturity, you’ll obtain a face worth of Rs.1,000.

Nevertheless, within the case of sovereign gold bonds, the examples stay the identical because the above authorities bond. However the one massive differentiator is that at maturity you aren’t receiving the face worth or the issued worth quantity. As a substitute, as per the RBI FAQs, “On maturity, the Gold Bonds shall be redeemed in Indian Rupees and the redemption worth shall be based mostly on a easy common of the closing worth of gold of 999 purity of earlier 3 enterprise days from the date of reimbursement, printed by the India Bullion and Jewelers Affiliation Restricted.”

It means it’s unknown to me the maturity quantity of SGB. The maturity quantity will likely be based mostly on the gold worth in the course of the time of maturity.

Nevertheless, many web sites and influencers promote the outdated problems with SGB by displaying the calculation of yield to maturity. By way of yield to maturity, as we don’t know the longer term maturity worth we get, how can one enter the now and arrive at YTM?

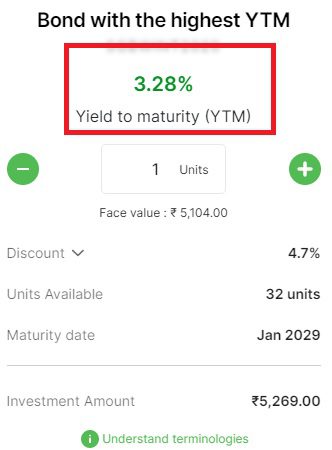

Take, for instance, an internet site referred to as Wintwealth displaying the YTM upfront to advertise the prevailing collection of SGB as under.

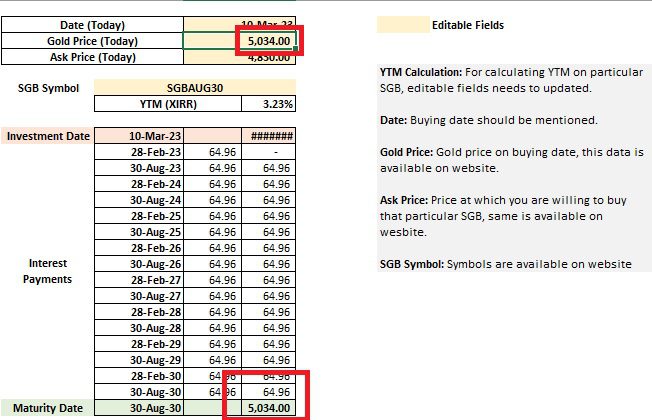

Should you click on on the hyperlink “perceive terminologies”, then there’s a hyperlink referred to as “Obtain YTM calculator”. The calculator reveals under.

You seen that within the funding date worth, they’re placing Rs.4,830 (which they confirmed as the present SGB worth) and on the maturity date, they’re displaying in the present day’s gold worth. As a substitute, it needs to be the maturity gold worth which we obtain at maturity and is UNKNOWN TO US NOW!!

Utilizing such calculators few influencers unfold misguidance on social media (particularly on Twitter). Beware…because the maturity worth is unknown to us now, we are able to’t calculate the yield to maturity of sovereign gold bonds at present. We are able to simply calculate the present yield which is predicated on the coupon we obtain for the present worth however not the YTM.